Share this article

![]()

Bitcoin tumbled over the weekend after a drone attack by Iran on Israel. Under the influence of tensions in the Middle East and the impending halving, the price fell from $68,000 to around $60,000 on Saturday, with $1.2 billion of long positions liquidated. Despite this sharp correction, MicroStrategy co-founder Michael Saylor expressed a positive outlook, saying, “Chaos is good for Bitcoin.”

Chaos is good for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

His statement was shared on X after Bitcoin’s weekend downturn eroded more than $1.5 billion from MicroStrategy’s holdings. Yet the company maintains a substantial profit of more than $6 billion.

Saylor’s comments drew mixed reactions within the crypto community. Some criticized his timing due to the ongoing international conflict, while others agreed with his view of Bitcoin as a “hedge against chaos.”

Historical data shows that Bitcoin often faces initial price drops during geopolitical instability, but tends to recover as it is seen as a long-term safe haven.

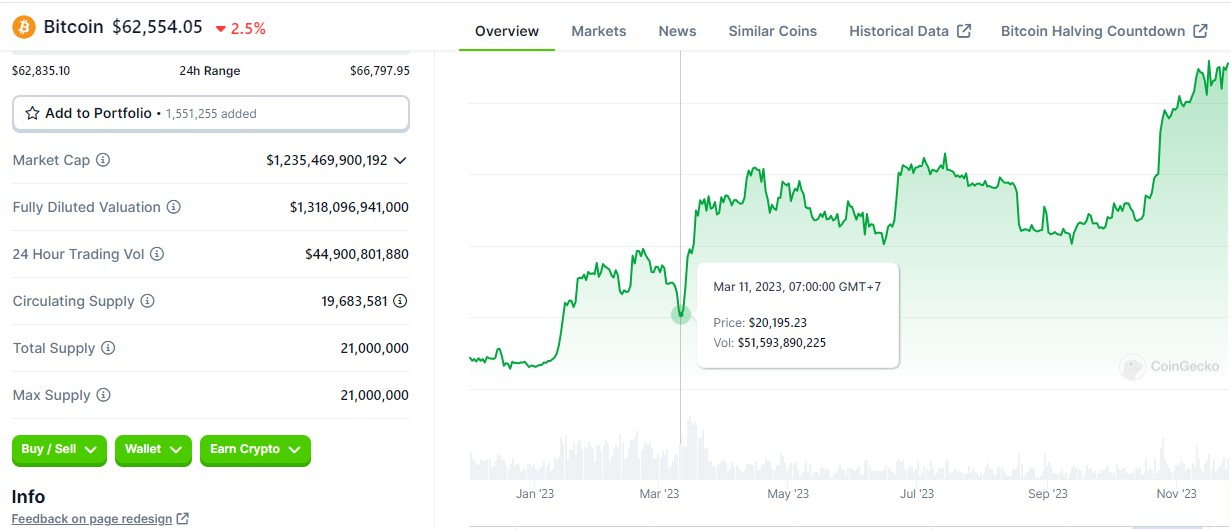

For example, after the Russia-Ukraine conflict began in February 2022, Bitcoin’s price fell to around $39,000, but within a week fell back to $44,000, according to data from CoinGecko. Similarly, after the Israel-Hamas conflict in October 2023, Bitcoin initially fell by 6%, but rose to $35,000 within a month.

Bank distress last March also reflects this pattern, although Saylor’s comment is not necessarily related to economic chaos.

When Silicon Valley Bank faced bank runs on March 10, 2023, Bitcoin’s price briefly fell below $20,500, but soon recovered and climbed to a nine-month high by the end of March. This recovery was further boosted by BlackRock’s application for a spot Bitcoin ETF.

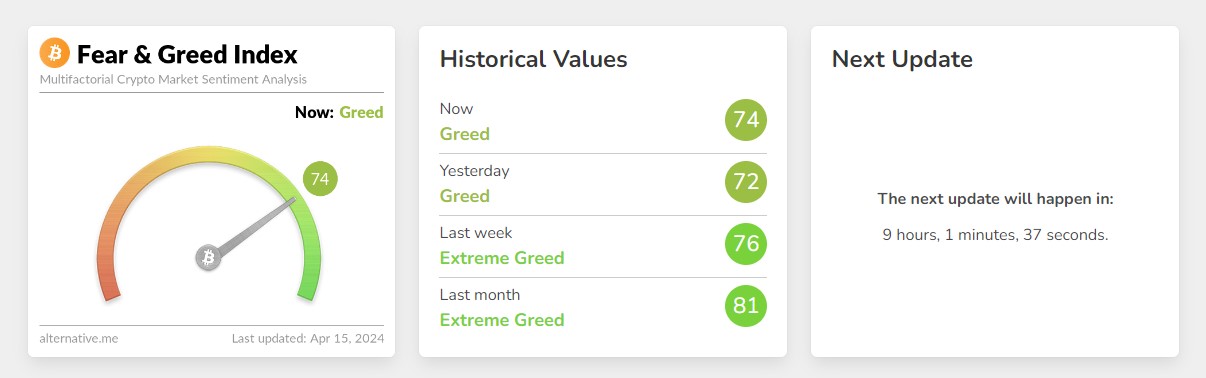

Despite recent war fears, Bitcoin market sentiment remains bullish. According to Alternatives’ data, the Fear and Greed index currently stands at 74, indicating “greed” – down from “extreme greed” but still reflecting strong investor confidence. This optimism is likely fueled by the impending halving event, which has historically been followed by a price spike for Bitcoin several months later.

Bitcoin reclaimed the $66,000 mark earlier today after Hong Kong officially approved spot Bitcoin and Ethereum ETFs. At the time of writing, Bitcoin is trading at around $62,500, down 2.5% in the last 24 hours, according to CoinGecko’s data.

Share this article

![]()

The information on or accessed through this website is obtained from independent sources that we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not provide personal investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become out of date, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing can supplement articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto-natives. All AI-augmented content is carefully reviewed, including for factual accuracy, by our editors and writers, and is always drawn from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision about an ICO, IEO or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice regarding an ICO, IEO or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sale, securities or commodities.

See full terms and conditions.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news