[ad_1]

Bitcoin (BTC) remains under pressure as markets open this week, with Bitcoin price trading above $66,000. In this article, follow the spotlight and explore events that BTC traders should keep watching this week.

The Bitcoin price action is surprisingly muted at press time. After a “packed” week, traders expected prices to fly.

Indeed, last week the crypto and Bitcoin community expected the US Federal Reserve to be more dovish than it turned out to be.

The central bank said it would cut interest rates only once this year, even with falling inflation moving closer to its benchmark of 2%.

Markets interpreted this as hawkish, lifting the USD.

Even with Bitcoin moving sideways above the $66,000 support line, the coin remains in an uptrend, adding 60% year-to-date.

(BTCUSDT)

Key drivers include the general expectation that the US Federal Reserve will cut interest rates after raising them rapidly throughout 2021 and early 2022. Another driver included the approval of spot Bitcoin ETFs in January.

Through this product, institutions can now gain exposure, which explains the rising demand for BTC.

The question is: Will spot ETFs fuel the uptrend and resume momentum this week?

All Eyes On Spot Bitcoin ETF Inflows

While Bernstein analysts acknowledge the importance of spot Bitcoin ETFs, it’s clear that demand has waned over the past few months.

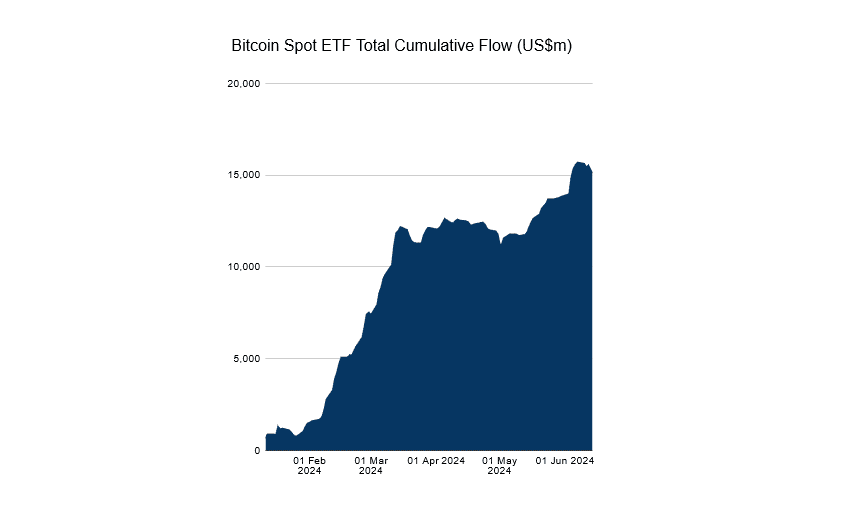

After raking in more than $15 billion in a record six months, this slowdown was mostly expected.

Even so, analysts expect inflows to increase as spot ETF issuers control more BTC in circulation.

According to Bernstein, spot ETF issuers such as Fidelity and BlackRock will soon control as much as 7% of all BTC in circulation by 2025. According to their estimate, this number will shoot up to as high as 15% by 2033.

As institutions pour in, they also expect Bitcoin prices to roar, predicting the coin will reach $200,000 by mid-2025.

Miners will continue to play a key role

Besides ETFs, the trading community will be keeping a close eye on mining activity this week.

By last week, the average BTC mining cost wash just over $86,000. If the uptrend will resume, prices must rise above this line, meaning miners are profitable.

#Bitcoin’s average mining cost is currently at $86,668.

And guess what? Historically, $BTC always rises above its average mining cost! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

Analysts think BTC is severely undervalued at spot rates and see this as an opportunity to double. Historically, when mining costs are higher than spot rates, prices tend to recover sharply in the sessions ahead.

Whether BTC prices will shoot higher remains to be seen. What is clear, however, is that miners were under pressure after the April 20 Halving.

Most sold to keep operations going.

#Bitcoin undergoes a rare miner capitulation. This one is from the halving event, which kills weak miners. As they die they dump BTC, the price recovers afterwards.

But first we need to clear that open interest in futures betting. Liquidations must occur before a pump. pic.twitter.com/xsSdg5QMsP

— Willy Woo (@woonomic) June 10, 2024

If this trend continues this week, BTC will likely plunge below $66,000 until miners’ reserves are depleted – at which point, theoretically, the Halving supply shock will finally bite.

DISCOVER: How to buy Spot Bitcoin ETF in June 2024

The bottom line: Key fundamental events to watch this week

Analysts expect market volatility this Friday as billions in stock options, index futures and index options expire.

Considering the increasing correlation between stocks and Bitcoin, it is not unlikely that this major market event could see Bitcoin price move as well.

Eyes will also be on United States retail sales on Tuesday and industrial production on Friday. If they rise or shrink, exceed or fall below economists’ expectations, Bitcoin can be affected.

EXPLORE: What are Bitcoin ETFs? A Beginner’s Guide

Disclaimer: Crypto is a high risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news