Bitcoin price today: $66,800

US Bitcoin Spot ETFs recorded a second straight day of inflows on Tuesday. Arkham Intelligence data shows that Tesla recently moved $760 million worth of Bitcoin to other wallets. Glassnode’s report highlights declining supply and demand for Bitcoin, predicting an increase in volatility.

Bitcoin’s (BTC) price stabilized around $67,000 on Wednesday after recovering and breaking above a key resistance barrier on Tuesday. The rise in BTC comes after US Spot ETFs recorded a second consecutive day of inflows of more than $373 million on Tuesday. However, some concerns have been raised due to the recent transfer of funds by Tesla, while a report from Glassnode highlights that BTC is expected to experience volatility in the short term.

Bitcoin Institutional Demand Shows Strength Despite Tesla Fund Movement In BTC

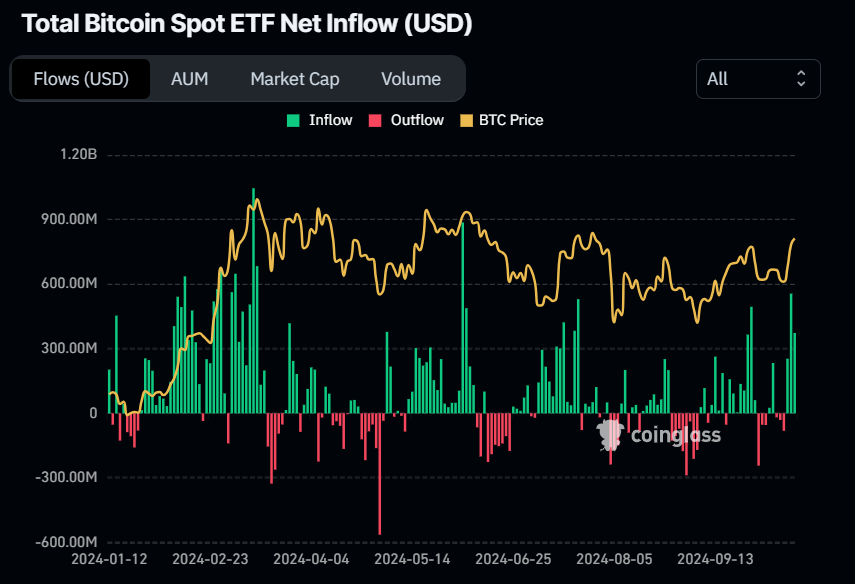

Institutional demand for Bitcoin is showing signs of strength. US Bitcoin Spot ETFs recorded a second consecutive day of inflows of $373.30 million on Tuesday, according to Coinglass data. Studying the ETF flow data can be useful in observing institutional investors’ sentiment. If the magnitude of inflow continues or increases, it will indicate a rise in demand for Bitcoin, further contributing to its price rise.

Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Despite rising institutional demand, Arkham Intelligence data shows that Tesla has moved $760 million worth of Bitcoin to other wallets since Tuesday. This transfer of funds is still unclear whether it was internal shuffling or sale.

“Even if they sell, the impact will be slightly more than half of the German government’s. Their realized profit was $816 million, while Tesla’s today is $515 million,” CryptoQuant founder and CEO Ki Young Ju said in a Twitter post.

A Glassnode report on Tuesday highlighted a notable gap between supply and demand for Bitcoin, which has traded range-bound for more than seven months. With low volumes across chain and futures markets and a HODLer-dominated environment, the scene is set for increased volatility in the near future, the report said.

On the demand side, Glassnode analysts explain that the rate of new capital inflows has continued to wane since the $73,000 all-time high set in March. Measuring the realized gain or realized loss metrics can serve as proxies for the extent of new capital entering or leaving the network.

Bitcoin absolute realized profit + realized loss chart. Source: Glassnode

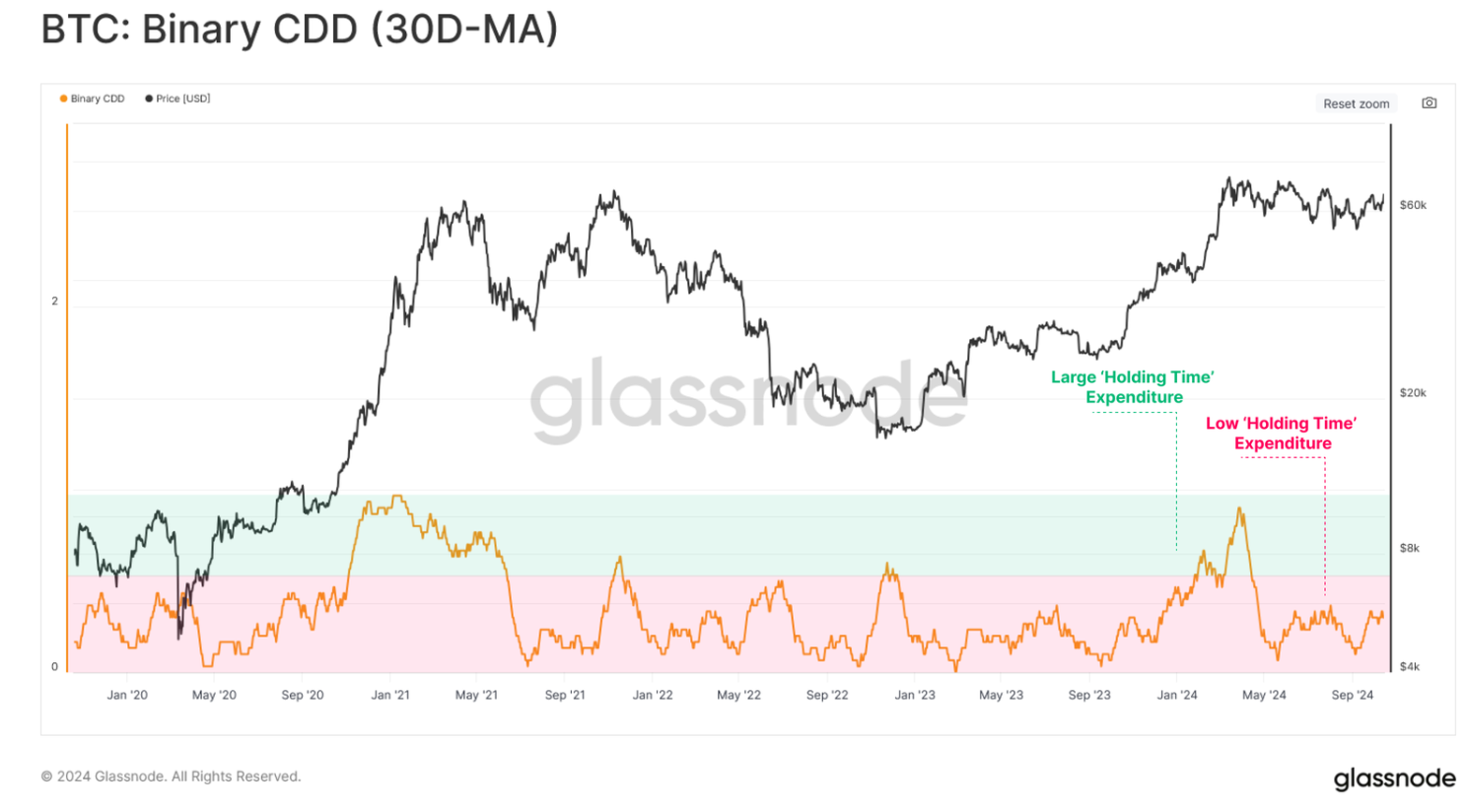

Moreover, the Binary CDD metric clearly assesses the demand side. This measure tracks the expenditure of “holding time” in the market, and follows when holders of old stock make large volumes of transactions.

The chart below shows a relatively light volume of coinday destruction, suggesting that long-term investors remain relatively inactive within the current price range. This indicates investor attention, and new demand inflows within this range are relatively muted.

Bitcoin Binary CDD chart. Source: Glassnode

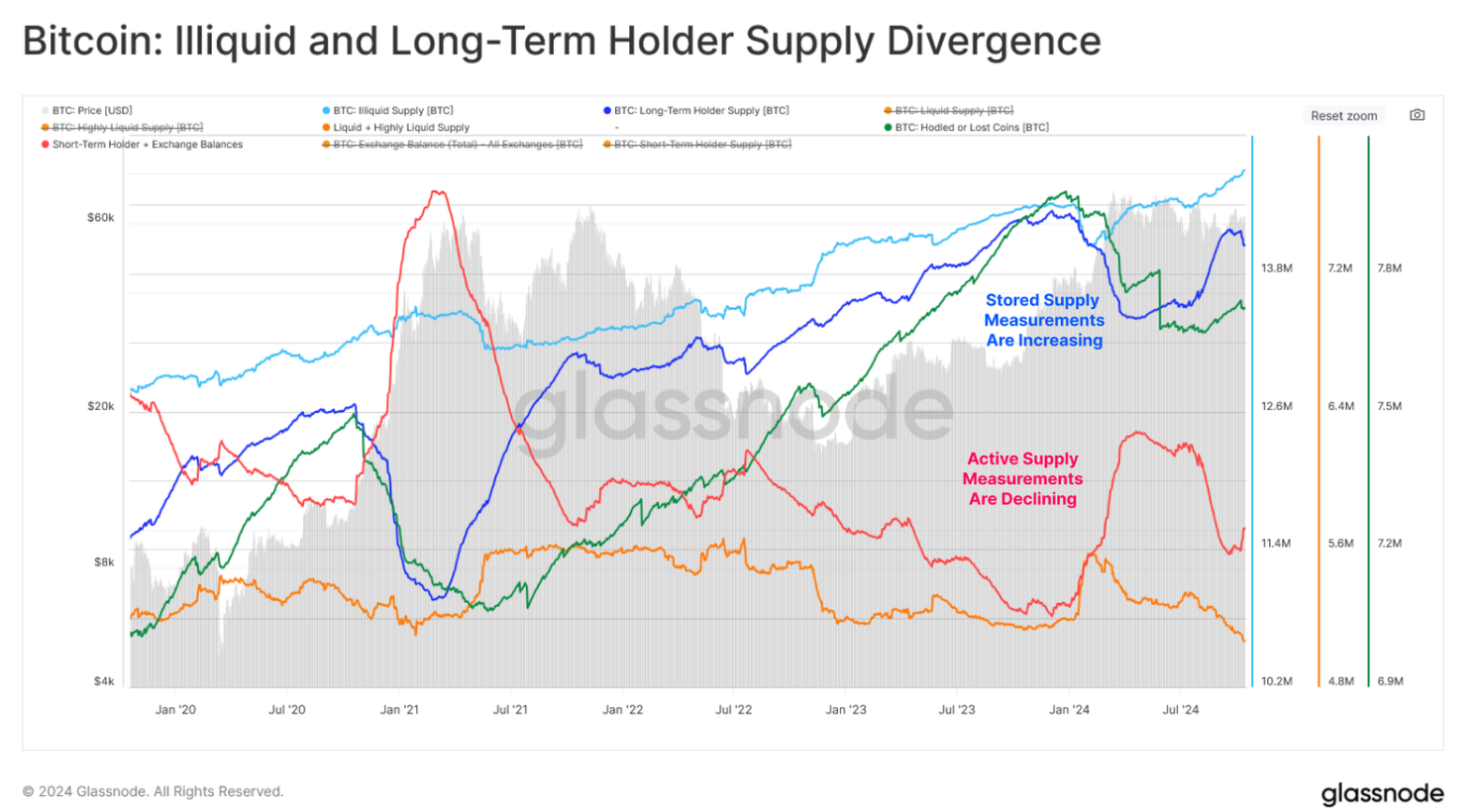

The report explains that available coins are also constrained on the supply side, with various measures of “active supply” compressed to relatively low levels. As shown in the chart below, acute tightness across the Bitcoin supply side has been a precursor to a regime of heightened volatility.

Bitcoin Illiguid and long-term holders supply chart. Source: Glassnode

New investor confidence in the market trend also remained within the neutral range, highlighting that spending by new buyers is not drastically different from the price of the original acquisition.

Despite the slightly negative sentiment caused by the recent turbulent market conditions, the level of confidence among new investors is significantly higher than in both the 2019-2020 and 2021 markets.

Bitcoin New Investor Confidence in Trend chart. Source: Glassnode

Bitcoin Price Prediction: BTC closes above $66,000 resistance

Bitcoin price broke on Tuesday and closed above the psychological level of $66,000, gaining 1.5%. As of Wednesday, it is trading slightly lower at around $67,000.

If the $66,000 holds as support, BTC could continue its ongoing rally to retest its July 29 high of $70,079.

The moving average convergence divergence (MACD) indicator is further supporting Bitcoin’s rise after posting a bullish crossover on the daily chart on Monday. The MACD line (blue line) moved above the signal line (yellow line), giving a buy signal. It also shows rising green histogram bars above the neutral line of zero, suggesting increasing upward momentum.

Furthermore, the daily chart’s Relative Strength Index (RSI) shows that Bitcoin is approaching its overbought level. It is trading at 65, near the overbought level of 70. If it enters the zone on a closing basis, traders would be advised not to add to their long positions as the chances of a pullback will increase. However, another possibility is that the rally continues and the RSI remains in the overbought zone. If it gets overbought and then goes back to the neutral level of 50, it will be a sign of a deeper correction.

BTC/USDT Daily Chart

However, if Bitcoin fails to find support around the $66,000 level and close below it, BTC could extend the 6% decline and retest its $62,000 support level, which corresponds to the 61.8% Fibonacci retracement level at $62,059 (drawn from the July high of $70,079) to August low of $49,084).

Bitcoin, altcoins, stablecoins FAQ

The largest cryptocurrency by market capitalization, Bitcoin is a virtual currency designed to serve as money. This form of payment cannot be controlled by any person, group or entity, eliminating the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also consider Ethereum a non-altcoin because it is from these two cryptocurrencies that forking takes place. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and thus an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset they represent. To achieve this, the value of any one stablecoin is tied to a commodity or financial instrument, such as the US dollar (USD), with its supply regulated by an algorithm or demand. The main purpose of stablecoins is to provide an on/off for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value, as cryptocurrencies are generally subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market cap to the total market cap of all cryptocurrencies combined. This gives a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically occurs before and during a bull run, in which investors turn to invest in relatively stable and high market cap cryptocurrency like Bitcoin. A drop in BTC dominance usually means investors shift their capital and/or profits to altcoins in search of higher returns, which usually triggers an explosion of altcoin rallies.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news