In a remarkable move, Bitcoin rose to $45,316, representing a gain of 7.06% on Tuesday. This break above $45K comes at a crucial time, right before a potential ETF approval that could significantly affect its market trajectory.

Amid these developments, ChatGPT sheds light on the role of artificial intelligence in predicting Bitcoin’s rise to a staggering $100,000 by 2024.

Meanwhile, political factors such as Donald Trump’s potential loss in the upcoming presidential election are speculated to cause a stock market crash and possibly usher in a new Great Depression.

Bitcoin breaks $45K barrier ahead of expected ETF approval

Bitcoin (BTC) has topped $45,000 for the first time in more than two years, and the price is expected to rise further with the upcoming approval of the first spot Bitcoin exchange-traded fund (ETF) in the United States.

The cryptocurrency’s value has now surpassed all 2023 highs, setting a significant new annual high just two days into 2024, after gaining more than 6% in the past 24 hours and 170% in the past year rose. The market is awaiting the SEC’s ruling on 14 pending applications for a spot Bitcoin ETF.

Bitcoin’s latest price increase has sparked controversy among market watchers, as it was last seen above $45,000 nearly 20 months ago in April 2022.

While some expect a potential “bull pennant” formation that would lead to a $54,000 gain upon SEC approval, others, like VanEck advisor Gabor Gurbacs, expect an initial drop but enormous trillions in inflows in the years ahead .

ChatGPT envisions AI’s role in Bitcoin’s potential rise to $100K

The latest incarnation of the AI chatbot, ChatGPT-4, suggests that Bitcoin’s price could reach $100,000 in 2024 under certain favorable conditions, citing variables such as positive legislative developments, growing adoption and currency depreciation.

Although considered highly speculative, ChatGPT demonstrates the potential positive impact of spot Bitcoin exchange-traded fund (ETF) approval, which will increase accessibility and liquidity while potentially attracting institutional investors.

“ChatGPT has a theory 🤖💡! Bitcoin could soar to $100k by 2024. Can the magic of #AI help #Bitcoin take this giant leap? Let’s dig into it 👉https://t.co/ ltzTMY6aFX. What are your thoughts on this exciting prediction, folks? #Cryptocurrency”

— Aitor (@Ozpaniard) January 1, 2024

ChatGPT highlights AI’s involvement in market analysis, trading techniques and larger blockchain technology improvements in response to how AI can contribute to this scenario.

Able to digest large amounts of market data and spot trends, AI algorithms can enable faster and more efficient trade execution, but they also warn against potential threats such as hacking and cyber attacks.

The findings of ChatGPT indicate a possible rise in Bitcoin values, due to AI’s influence on market dynamics and trading techniques.

Trump’s election loss could signal a stock market crash, AI warns

Former US President Donald Trump has offered a dire warning about the US economy, predicting a stock market crash worse than 1929 and a Great Depression if he does not win the presidential election.

Trump has attacked the current state of the economy, crediting its survival to his administration’s achievements. He claimed that the stock market’s strong valuation was due to the expectation of his election victory in 2024.

Donald Trump warns of stock market crash and Great Depression if he does not win presidential election

— Bradicoin (@Bradicoin10) January 2, 2024

While official figures from the Bureau of Labor Statistics show a 17% rise in prices since President Joe Biden took office, Trump claims inflation has exceeded 30% in the past three years.

MORE: “If I don’t win, it’s my prediction that we’ll have a stock market ‘crash’ worse than that of 1929 – A Great Depression!!!” Trump wrote on Truth Social Friday night. “Make America Great Again!” https://t.co/UYey17LQrW

— NEWSMAX (@NEWSMAX) December 30, 2023

The impact of Trump’s warnings on Bitcoin prices remains theoretical, but historical evidence suggests that his re-election could trigger a positive reaction in the cryptocurrency market, with Bitcoin expectations reaching all-time highs.

Bitcoin Price Prediction

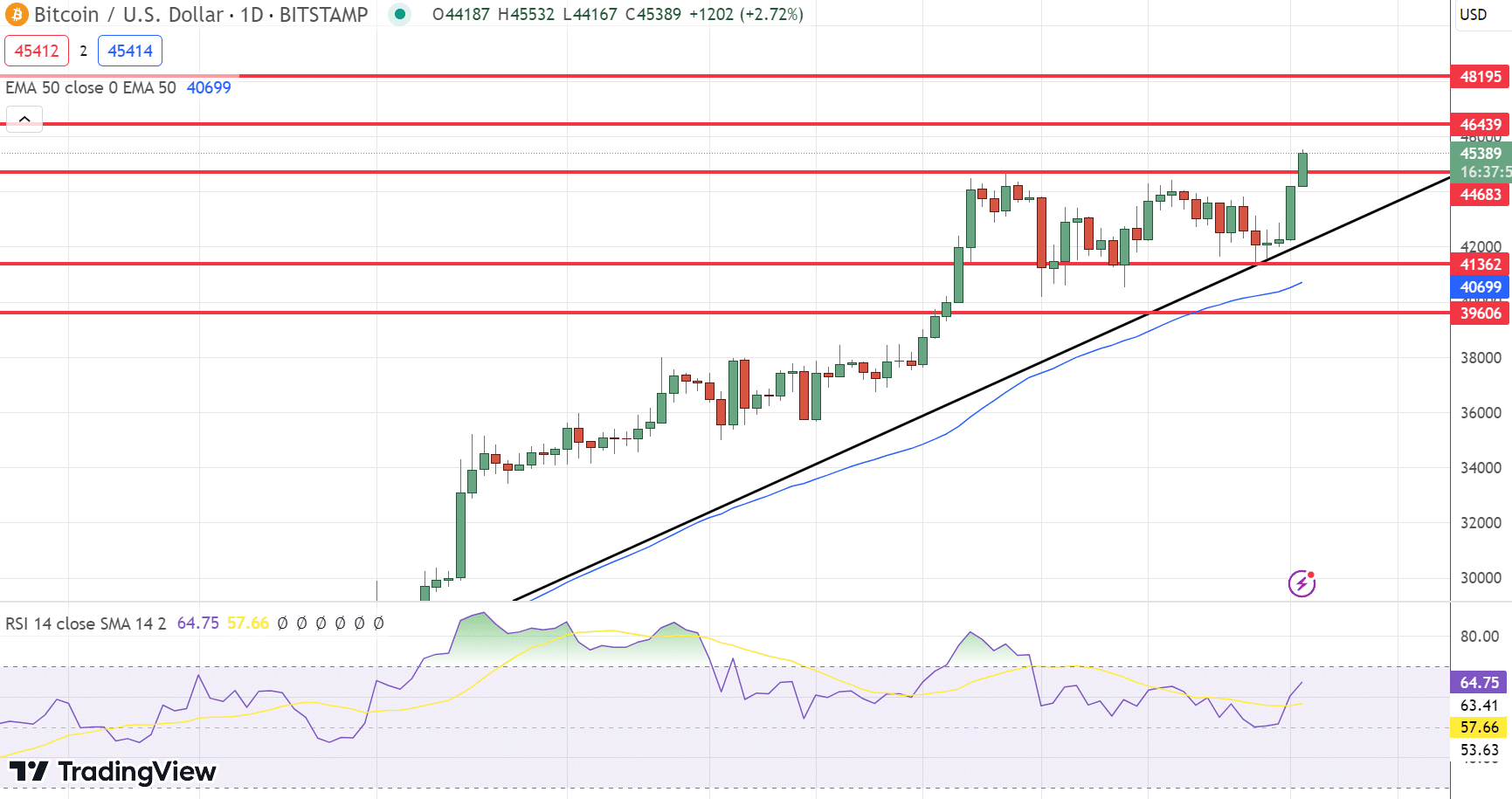

On January 2, Bitcoin, the pioneering cryptocurrency, showed a significant upward trend, marking an impressive start to the new year. Trading around the $44,501 pivot, Bitcoin shows potential for further gains, as indicated by key technical levels and market sentiment.

Immediate resistance levels for Bitcoin are set at $46,439, $48,195 and $49,857. These levels serve as potential targets for Bitcoin’s upward journey, suggesting room for growth if the bullish momentum continues. Conversely, support levels are identified at $43,096, $41,884 and $40,238, which provide crucial thresholds that could protect Bitcoin from any significant price declines.

The technical indicators present a compelling picture. The Relative Strength Index (RSI) stands at a high of 81, indicating overbought conditions. This level may indicate that Bitcoin may be approaching a short-term peak, with potential for a correction or consolidation in the near future. However, the RSI also reflects the strong buying interest and momentum that has characterized Bitcoin’s recent market movement.

Adding to this bullish narrative is the sighting of the ‘Three White Soldiers’ candlestick pattern, typically seen as a bullish signal. This pattern indicates a strong buying trend and may indicate that investors are confident about Bitcoin’s prospects. However, the overbought RSI warrants a cautious approach as the market may be poised for a volatility swing.

Finally, the technical analysis indicates a bullish trend for Bitcoin, with the cryptocurrency aiming to test and possibly breach higher resistance levels.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news