In Crypto, the European Union today is expanding its supervision of digital asset companies. Crypto funds have seen strong inflows amid concerns about the US government’s closure, and a multicoin capital manager said the genius law could eventually give traditional banks a run for their money.

EU -eyes crypto supervision under Esma to terminate fragmented supervision

The European Union’s Markets Regulator is preparing to expand its authority to cover cryptocurrency exchanges and other operators, says a move officers will better align oversee the newly implemented Markets of the BlOC in Crypto Assets (Mica) framework.

Verena Ross, chairman of the European Securities and Markets Authority (Esma), confirmed in an interview with the Financial Times that the European Commission is developing plans to move oversee various financial sectors, including Crypto, from national regulators to Esma.

Ross said the reform will help build a more integrated and global competitive ‘EU financial landscape. The proposal aims to address “continued fragmentation in markets” and move closer to a united capital market in Europe, she said.

In terms of the current Mica regime, licenses for the Crypto-asset service providers are issued by national authorities rather than a central EU body.

Smaller member states have so far led the launch. Earlier this year, Lithuania granted his first license at Robinhood Europe discounts, while Malta authorized large exchanges, including OKX and Crypto.com. In Luxembourg, Bitstamp and Coinbase also secured Mika licenses.

Ross argued that the delegation of supervision of individual countries created inefficiencies, forcing each national authority to build its own expertise and supervision systems. Esma also expressed concern about the inconsistent licensing standards, including an overview of July that criticized elements of Malta’s authorization process.

Crypto Funds Smash Records with inflow of $ 5.95 billion amid concern

Cryptocurrency investment products recorded their highest inflow last week, as the US government fueled a rally in place of Crypto markets.

Global Crypto Exchange Traded Products (ETPs) have $ 5.95 billion in the week ended Friday-the largest that has ever been seen on Monday.

‘We believe it was due to a delayed response to the FOMC [Federal Open Market Committee] Interest rate cut, exacerbated by very poor employment data […]and concerns about US government stability after the closure, ”said James Butterfill, head of research at Coinsshares.

The record inflow came amid an overall bullish trend in Crypto markets, which led Bitcoin (BTC) to register a new historic high of more than $ 125,000 on Saturday.

With $ 5.95 billion inflow, Crypto ETPs exceeded the previous record of $ 4.4 billion from mid -July by 35%.

Unlike the previous record inflow, which is almost evenly distributed between Bitcoin and Ether (Ether), the latest profits are strongly dominated by BTC, with Bitcoin funds attracting a record-breaking $ 3.6 billion.

“Despite prices that closed at all highlights during the week, investors did not choose to buy short investment products,” Coinshares Butterfill noted.

Ether ETPS had $ 1.48 billion inflow, which pushed the year-on-date inflow to another record of $ 13.7 billion, which was close to the threefold who was last year, Butterfill said.

Solana (Sol) ETP inflow ranked third at $ 706.5 million, while XRP (XRP) added $ 219.4 million, with both records, according to Coinshares.

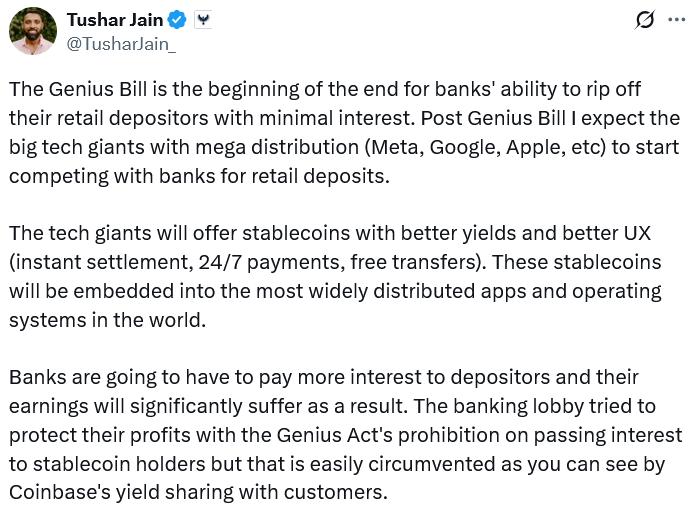

Genius Act can mark the end of the banking rip-off: Multicoin

According to the co-founder of Multicoin Capital, the stableecoin-focused Genius Act, issued in July, will cause an exodus of deposits from traditional bank accounts to higher yields stableoins.

“The genius bill is the beginning of the end for the ability of banks to tear off their retailed depositors with minimal interest,” Multicoin Capital’s co-founder and managing partner, Tushar Jain, posted to X on Saturday.

“Post Genius Bill, I expect the great technology giants with mega distribution (Meta, Google, Apple, etc.) to compete with banks for retail deposits,” Jain added and argued that they would provide better stable COIN returns with better user experience for direct settlement and 24/7 payments above traditional bank players.

He noted that in mid -August banking groups tried to protect their profits by calling on regulators to close a so -called loophole that could enable stableecoin issuers to pay interest or returns on stableecoins through their subsidiaries.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news