2023 was a year of recovery for cryptocurrency markets, with asset prices and market sentiment improving over the course of the year after a challenging 2022. But how well did investors actually do? In this blog, we share our 2023 estimates of crypto profits based on investors’ interactions with centralized exchanges, including a breakdown of estimated profits by country.

Our methodology: How we calculate cryptocurrency profits and estimate profits per country

We use on-chain data to estimate investors’ cryptocurrency profits based on movements of crypto-assets in and out of services where they can be purchased or withdrawn in fiat currency. Specifically, we begin by measuring the on-chain, macro-level flows of a select group of assets that account for approximately 80% of the total market capitalization for all cryptocurrencies, and that are traded on large centralized exchanges that crypto-na- fiat conversion offers . Then we estimate the total, collective gains made on each asset by measuring the differences between the US dollar value of all withdrawals from the asset and the value of all deposits from the asset. The methodology is based on the fact that any deposit to a service offer represents a possible conversion into cash, and therefore realization of any gains or losses on the asset. Although the methodology is not perfect, it gives us a strong estimate of profits on popular assets traded on centralized exchanges.

Once we estimate the earnings on cryptoassets for users of each service we track using this methodology, we distribute those earnings to individual countries based on the share of web traffic each country represents for each service’s website. This combination of transaction data and web traffic is also the same framework we use to calculate our yearly Global Crypto Adoption Index.

2023 estimated total cryptocurrency profits

Overall, we estimate that all crypto investors achieved total profits of $37.6 billion in 2023.

While this total is much smaller than the $159.7 billion in gains made during the 2021 bull market, it represents a significant recovery from 2022, which saw estimated losses of $127.1 billion. Interestingly, our total profit estimate for 2023 is lower than 2021, despite crypto asset prices growing at similar rates in each of those two years. One possible explanation for this could be that investors were less likely to convert crypto assets into cash in 2023, expecting prices to rise even higher, as they did not surpass previous all-time highs in 2023, unlike in 2023 . 2021.

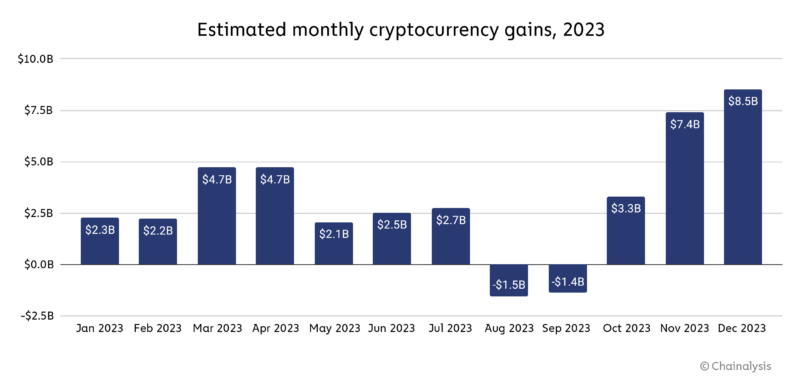

Crypto gains were relatively consistent throughout the year before two straight months of losses in August and September. Profits rose sharply after that, with November and December dwarfing all previous months.

2023 estimated cryptocurrency profits by country

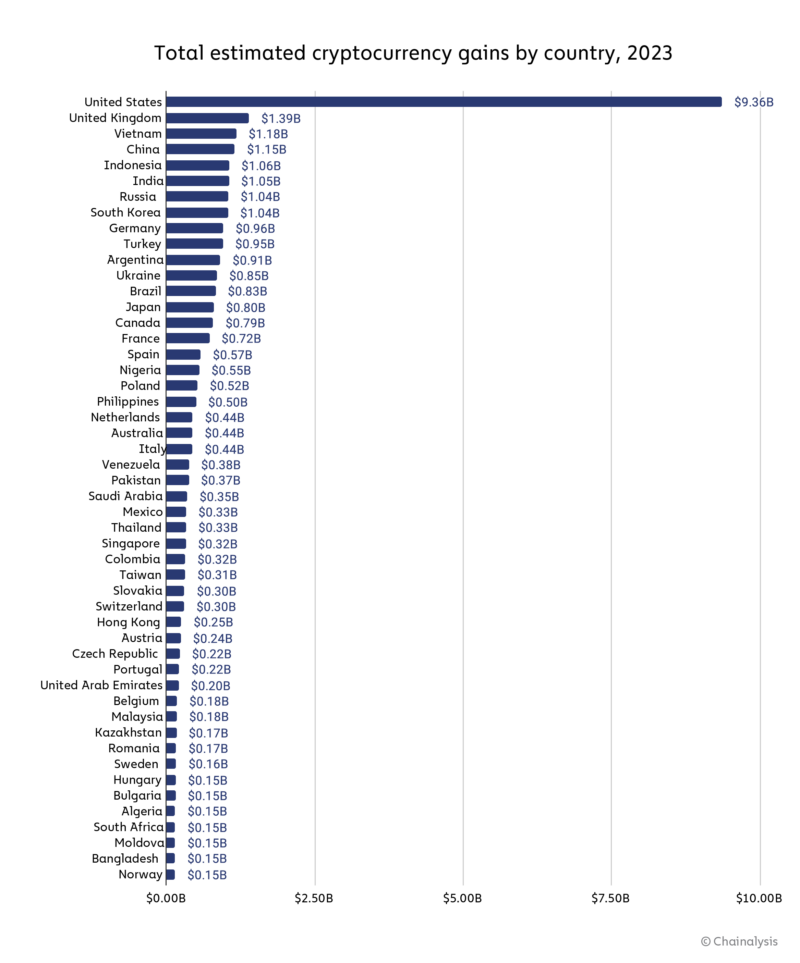

The United States led the way in cryptocurrency earnings by a wide margin in 2023 at an estimated $9.36 billion. The United Kingdom placed second with an estimated $1.39 billion in crypto profits.

Interestingly, we also see several upper and lower middle income countries whose residents appear to have made exorbitant profits, especially in Asia – Vietnam, China, Indonesia and India, for example, all made more than $1 billion in estimated profits, and are in the top six for all countries. We have previously noted in our 2023 Geography of Cryptocurrency Report that countries in these income categories, and especially lower-middle-income countries, have shown strong cryptocurrency adoption that has remained remarkably resilient even through the recent bear market. Our profit estimates suggest that many investors in those countries benefited from their embrace of the asset class.

What could 2024 hold?

So far, the positive trends from 2023 have carried over into 2024, with notable crypto-assets like Bitcoin hitting all-time highs in the wake of Bitcoin ETF approvals and increased institutional adoption. If these trends continue, we may see gains more in line with those we saw in 2021. As of March 13, Bitcoin is up 65.4% and Ether is up 70.2% in 2024.

This website contains links to third party websites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the Site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only and is not intended to provide legal, tax, financial or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with the Recipient’s use of these materials.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and shall not be responsible for any claim attributable to errors, omissions or other inaccuracies of any part of such material.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news