The third panel of DAO Tokyo centered around the evolving legal status of decentralized autonomous organizations (DAOs). The discussion underlines the complex and multifaceted nature of DAO incorporation, showcasing a range of perspectives and highlighting both the opportunities and challenges associated with establishing legal frameworks for these new organizations.

Ultimately, finding the optimal legal path for a DAO requires a nuanced approach, balancing the core principles of decentralization with the practical necessities of operating in the real world. This ongoing conversation highlights the importance of collaboration, community engagement and ongoing dialogue with regulators to create a supportive legal environment for the continued growth and evolution of the DAO ecosystem.

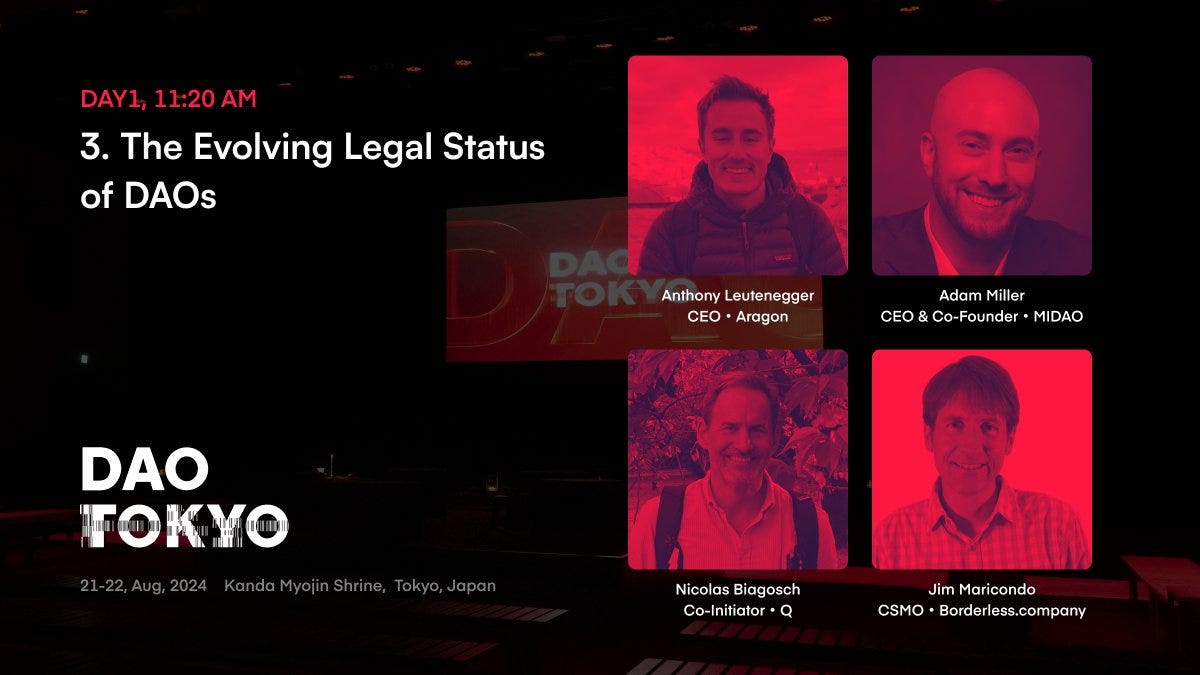

Adam Miller: Co-founder and CEO of MIDAO Directory Services, which developed an approach tailored specifically for DAOs in the Marshall Islands.Nicolas Biagosch: Co-initiator of the Q Protocol, a governance framework for Web3.Anthony Leutenegger: CEO of Aragon, a pioneer in DAO frameworks.Jim Maricondo: CMO of Borderless.company, a Japanese project aimed at facilitating legally compliant DAOs in Japan and beyond.

The key takeaways and recommendations for navigating the evolving legal landscape of DAOs highlight the need for pragmatism, careful planning and adaptation.

No one-size-fits-all solution: There is no universally applicable legal framework for DAOs. Each project must assess its unique needs, goals and stage of development to determine the most appropriate approach. Clarity and transparency: Honesty and transparency regarding governance structures and decision-making processes are crucial to navigating regulatory landscapes and building trust with stakeholders. Strategic decentralization : Decentralization must be a deliberate and well-planned process, strategically implemented to align with the project’s goals and regulatory considerations. Seek expert guidance: Engage experienced legal counsel and advisors specializing in DAOs and Web3 is essential for navigating complex legal frameworks and reducing potential risks. Continuous learning and adaptation: The legal landscape for DAOs is constantly evolving. Projects must stay informed of new developments, engage in ongoing dialogue with regulators and adapt their legal frameworks accordingly.

The necessity of legal enclosures: a spectrum of opinions

The discussion begins by examining the fundamental question: do DAOs need legal wrappers? The panelists offer nuanced viewpoints based on their diverse experiences and philosophies, revealing a spectrum of opinions rather than a definitive answer.

Adam advocates the use of legal wrappers, highlighting the inherent legal risks associated with collective activities in almost all jurisdictions worldwide. He explains that individuals involved in a DAO can be held personally liable by default for any obligations incurred through the DAO, exposing their personal assets to potential legal claims. Legal shells, such as the DAO LLC established in the Marshall Islands, provide a liability shield that separates the DAO’s actions from its members’ personal finances, similar to traditional companies.

Furthermore, legal wraps offer practical benefits, including:

Tax optimization: Prevents members from being personally liable for the DAO’s tax obligations. Facilitation of Web2 interactions: Enables the DAO to open bank accounts, sign contracts and engage in traditional financial activities. Improved credibility and trust: The provision of a recognizable legal framework for stakeholders, facilitating interactions with traditional businesses and institutions.

Adam argues that creating a legal entity for a DAO reflects standard practice for traditional startups seeking liability protection and operational functionality.

Nicolas expresses a more cautious attitude towards legal enclosures, offering a vision of DAOs operating in a borderless, digital economy independent of nation-states. He views legal wrappers as potentially conflicting with the decentralized nature of DAOs, tying them to specific jurisdictions and imposing external governance structures that could undermine the DAO’s autonomy.

Nicolas recognizes the pragmatic benefits of legal wrappers, particularly in facilitating real-world interactions and providing operational clarity. However, he suggests exploring alternative legal frameworks that recognize the unique features of DAOs without compromising their fundamental principles. He highlights the Q Protocol’s approach, which establishes a private contract (constitution) between DAO members, outlining governance rules, accountability frameworks and dispute resolution mechanisms, potentially independent of any specific legal jurisdiction.

Navigating the Legal Landscape: Jurisdictional Considerations

Recognizing the complexity and lack of clarity surrounding DAO legalization, the panelists delve into the various jurisdictional options available, highlighting their strengths and weaknesses.

Adam is promoting the DAO LLC in the Marshall Islands as a solution designed specifically for DAOs and Web3. He recounts his experience searching for a suitable legal enclosure, encountering limitations in existing frameworks that clashed with the decentralized vision of his DAO.

The Marshall Islands DAO LLC offers several benefits:

Flexibility and autonomy: No mandatory board or managers, allowing for decentralized management structures. Anonymity: No requirement to disclose names and addresses of members, preserving privacy. Web3 integration: On-chain record keeping and accounting allowed, streamlining operations and minimizing bureaucracy.

Adam acknowledges the prevalence of traditional jurisdictions such as the Cayman Islands, Switzerland and Delaware for crypto projects, attributing this to familiarity, legal precedent and existing infrastructure. However, he believes the Marshall Islands’ offering offers a more tailored and adaptable solution for truly decentralized DAOs.

Nicolas highlights the Q Protocol’s ability to establish a jurisdiction-agnostic legal framework, enabling internal organization and liability definitions without immediate reliance on external legal entities. This framework, which includes a constitution and dispute resolution mechanisms through the ICC Court of Arbitration, creates a legally recognized structure that can potentially interact with multiple jurisdictions without being tied to one specific location.

Nicolas acknowledges that legal wrappers may become necessary at later stages, depending on the DAO’s activities and growth. However, the Q Protocol’s initial framework allows for flexibility and reduces the risk of premature legalization compromising the DAO’s decentralized nature.

Jim sheds light on the recent developments in Japan, where a new DAO LLC framework was introduced in April 2024, signaling a progressive approach to DAO legalization. While still in its early stages, this framework aims to facilitate legal compliance for DAOs operating in Japan, potentially paving the way for wider adoption and recognition in the future.

Jim explains that Borderless.company is building a platform to simplify the process of establishing DAOs under this new framework, focusing on reducing operational friction and enabling fundraising through digitized equity tokens. make. He acknowledges limitations, such as the current requirement that members live in Japan, but emphasizes the potential for future expansion and internationalization.

Avoid pitfalls: Common mistakes and legal nuances

The panelists share their experiences and insights regarding common pitfalls and potential pitfalls associated with DAO incorporation, and emphasize the importance of thoughtful planning and strategic decision-making.

Anthony highlights the common pitfall of projects decentralizing prematurely, often driven by a fear of regulatory scrutiny or a desire to capitalize on market trends. He cautions against launching tokens before product-market fit is achieved and neglecting legal considerations in the rush to decentralize.

Anthony emphasizes the importance of due diligence, legal advice and clear goal setting before starting the legalization process. He argues that projects should honestly assess their stage of development, consider their goals and determine the appropriate legal approach accordingly.

Anthony further points to the risk that legal wraps burden projects with excessive bureaucracy, diverting resources and energy away from important product development and user engagement. He warns that premature incorporation can trap startups in complex legal processes, hinder their agility and ultimately affect their success.

Nicolas cautions against viewing legal wraps as a “silver bullet” that automatically solves all regulatory challenges. He emphasizes the need for transparency and a genuine commitment to decentralization, and warns against the superficial adoption of decentralized structures while maintaining centralized control in the background.

Nicolas talks about his experience with Q protocol, where regulators prioritized understanding the organization’s governance structure and ensuring the absence of centralized control mechanisms before granting regulatory clearance. He emphasizes that transparency and authentic decentralization are crucial for building trust and gaining long-term regulatory acceptance.

Adam recognizes the pervasiveness of off-chain governance mechanisms such as Snapshot combined with multi-sig wallets in the DAO space. Although not truly decentralized, he suggests that legal wrappers could potentially be used to enforce the execution of community votes by multi-sig signers, aligning their actions with the DAO’s wishes and the risk associated with centralized control to soften.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news