You might also like:

The amount of money currently locked up in DeFi stands at around $106.2 billion, up from just $10.3 billion at the start of 2020.

To help you get a sense of what’s happening in this exciting space, we’ve compiled a list of 19 fast-growing DeFi startups to watch based on search growth data and VC funding.

Read below for our top DeFi startups that are establishing themselves as leaders in the decentralized finance space.

1. Jupiter Exchange

5-year search growth: 1,150%

Search Growth Status: Exploding

Year founded: 2021

Location: New York, New York

Funding: Undisclosed

What they do: Jupiter is a decentralized exchange aggregator built on the Solana blockchain. It searches across different DEX liquidity pools to find the best prices and most efficient trading routes for token swaps. Jupiter Token (JUP) was launched in January 2024 and currently has a market cap of $1.35 billion.

2. dYdX

5-year search growth: 900%

Search Growth Status: Peak

Year founded: 2017

Location: San Francisco, CA

Funding: $87M (Series C)

What they do: dYdX is one of the leading DeFi exchanges out there right now, and also one of the few that has raised money the traditional way (Series A, Series B).

The exchange runs on audited smart contracts on the Ethereum blockchain, allowing DeFi to take off, but with the security and flexibility of a more centralized exchange, such as a Coinbase. dYdX was founded by a former Coinbase engineer, Antonio Juliano.

3. Rocket pool

5-year search growth: 2,500%

Search Growth Status: Peak

Year founded: 2016

Location: Brisbane, Australia

Funding: Unknown (Initial Coin Offering)

What they do: If you’ve had any exposure to the cryptocurrency world, you may have heard the term “staking.” Staking basically means using crypto to secure the blockchain while earning rewards, interest or tokens for your participation.

Playing on the Ethereum blockchain is too technical, complicated and risky for many people without a coding background. Enter Rocketpool. Rocketpool is a staking option that allows users to stake with less than required minimums while making the process more accessible.

4. DeBank

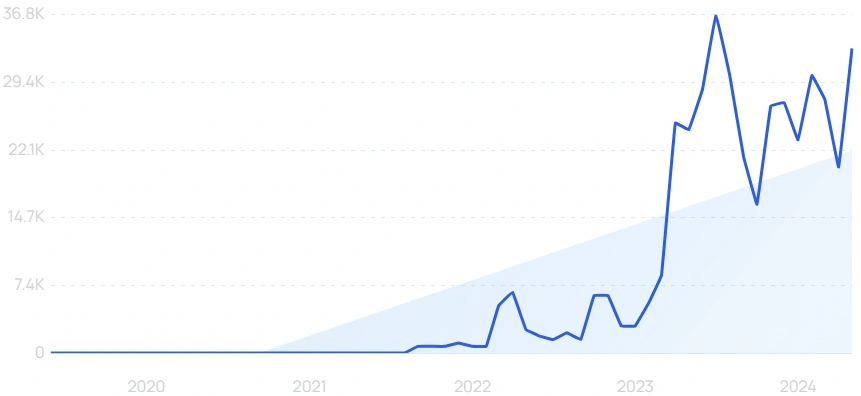

5-year search growth: 6,600%

Search Growth Status: Regular

Year founded: 2017

Location: Singapore, Singapore

Funding: $25M (Series A)

What they do: DeBank is a DeFi dashboard and portfolio tracker where users can manage their investments. Within the DeBank platform you will find decentralized lending protocols, stablecoins, margin trading platforms and DEXs. In total, the dashboard tracks 1,704 protocols across 44 blockchain networks.

5. Egg layer

5-year search growth: 3,700%

Search Growth Status: Regular

Year founded: 2020

Location: Seattle, Washington

Funding: $64.4M (Series A)

What they do: EigenLayer is an Ethereum protocol that allows users to re-stake their ETH or Liquid Stakeed Tokens (LST) through smart contracts to earn additional interest on their staked ETH. Developers can also take advantage of the pooled security of Ethereum’s stakeholders, which promotes permissionless innovation and free market governance. In June 2024, EigenLayer’s total value closed (TVL) exceeded $20 billion.

6. Solflare

5-year search growth: 4,900%

Search Growth Status: Regular

Year founded: 2015

Location: La Mesa, California

Funding: Undisclosed

What they do: Solflare is a cryptocurrency wallet built specifically for the Solana blockchain. Users can send, receive, store and exchange both native SOL tokens and SPL tokens (Solana’s equivalent of ERC-20 tokens). According to the new company’s website, they currently have over $14.3 billion in play and 73.95 million users.

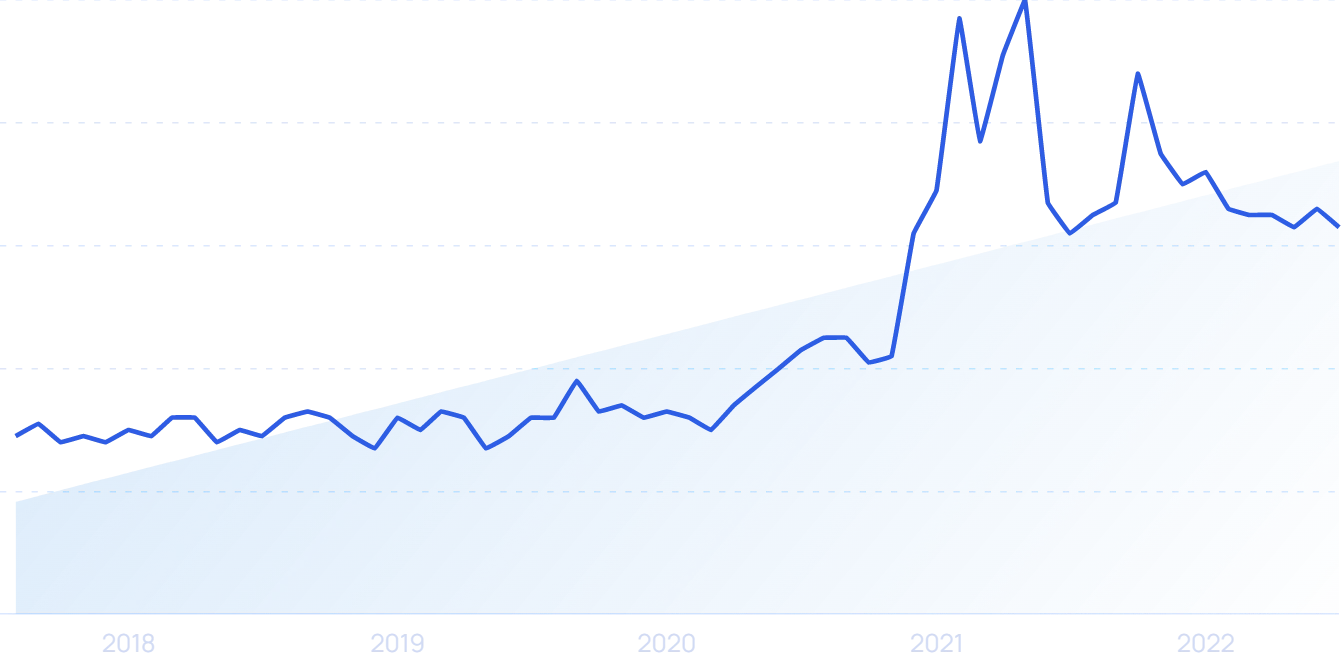

7. Balancer

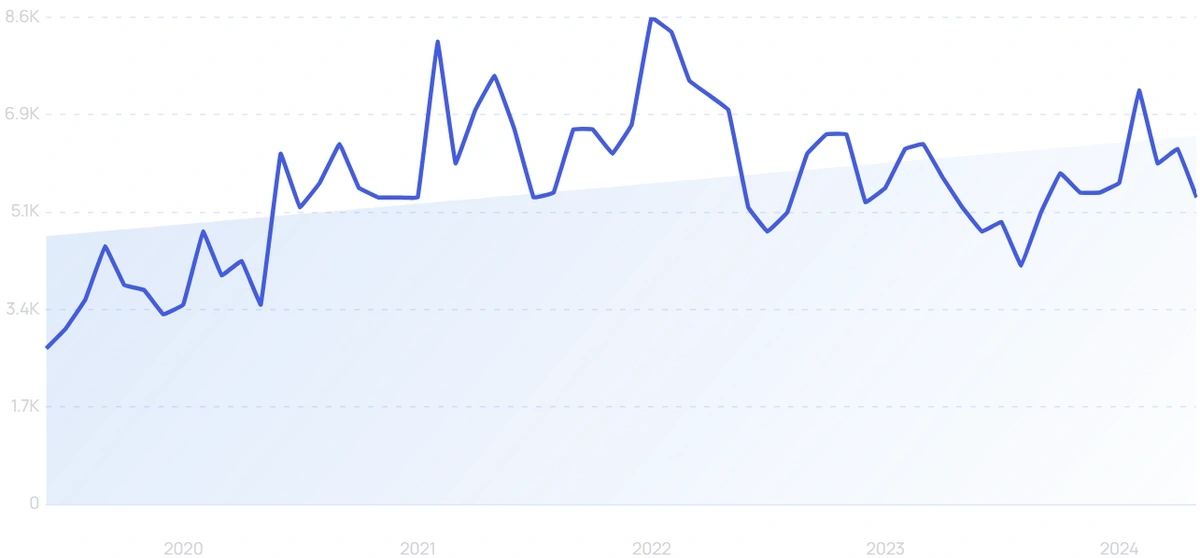

5-year search growth: 23%

Search Growth Status: Exploding

Year founded: 2018

Location: Lisbon, Portugal

Funding: $32.3M (Series Unknown)

What they do: Like many of the other DeFi startups on this list, Balancer operates as a decentralized protocol for exchanging tokens, providing liquidity pools, and working as an automated market maker.

Balancer’s value proposition is that instead of paying a portfolio manager to rebalance your portfolio, you collect fees from traders who rebalance your portfolio for you.

8. Commute Finance

5-year search growth: 5,100%

Search Growth Status: Regular

Year founded: 2020

Location: Denver, Colorado

Funding: $3.7 million (seed)

What they do: Pendle Finance is a DeFi protocol that runs on the Ethereum blockchain. Unlike other DeFi platforms, Pendle offers returns in the form of tradable tokens. The startup’s native token, PENDLE, has soared after announcing a strategic partnership with Coinbase-backed Ondo Finance.

9. UniSat

5-year search growth: 675%

Search Growth Status: Exploding

Year founded: 2023

Location: Hong Kong, Hong Kong

Funding: unknown (seed)

What they do: UniSat is a non-custodial cryptocurrency wallet on the Bitcoin blockchain. It can store, transfer and write Bitcoin ordinals and BRC-20 tokens. Recently, the company announced that it had reached 1 million weekly active users.

10. Banking

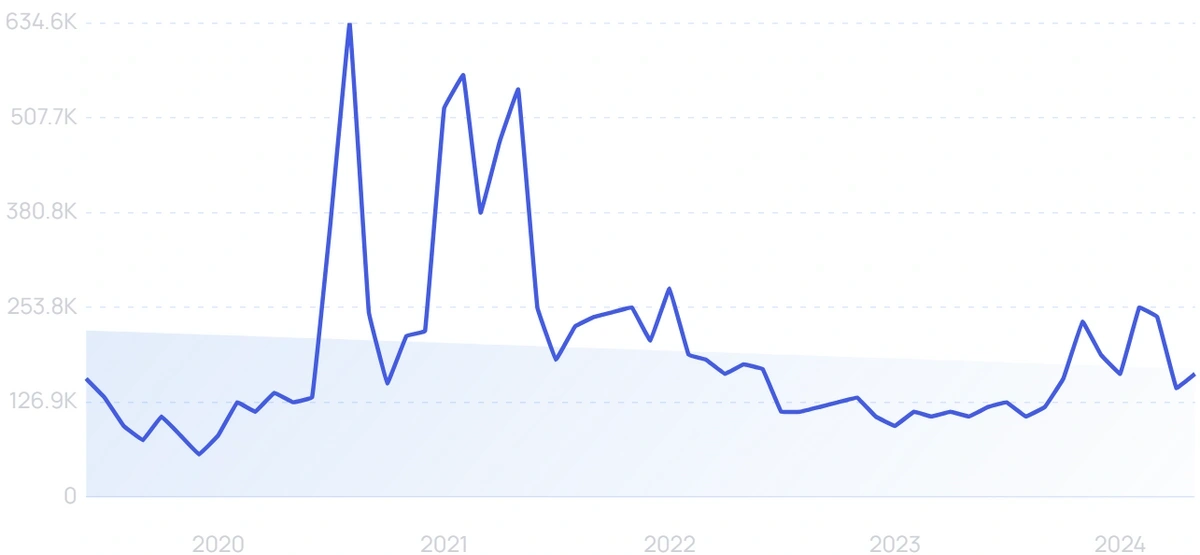

5-year search growth: -45%

Search Growth Status: Peak

Year founded: 2016

Location: Zug, Switzerland

Funding: $152.3 million (seed)

What they do: Bancor was one of the first players in DeFi. And encountered many peaks and valleys along the way. Billed as the people’s bank, it allows users to generate cryptocurrencies and functions as another decentralized exchange.

What makes Bancor unique is that it was one of the first, evidenced by its massive funding round via ICO. Today, the start-up has grown quite a bit, but still works internally on innovation.

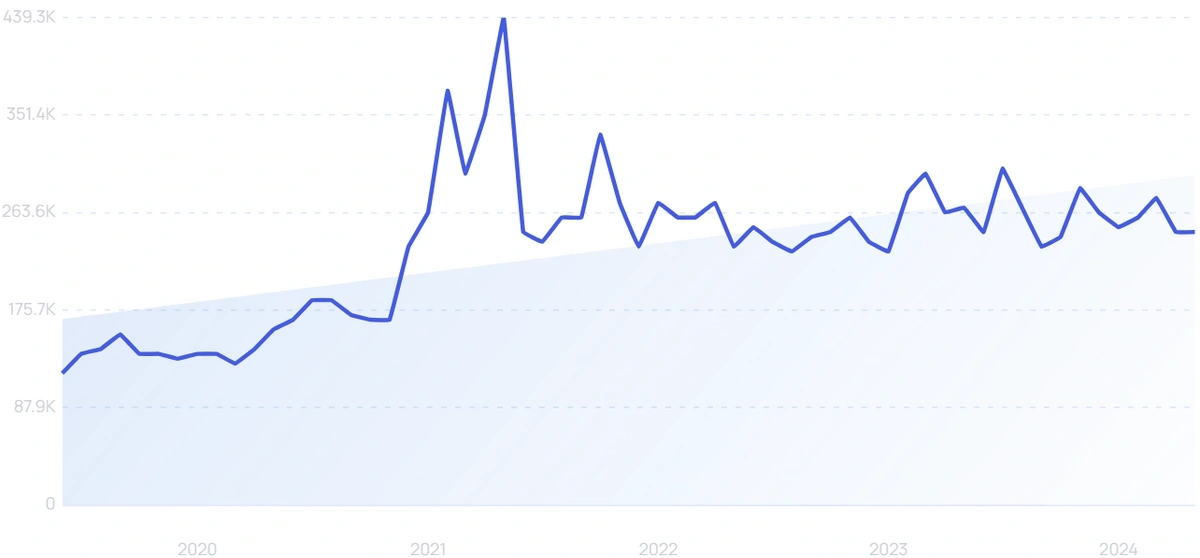

11. MakerDao

5-year search growth: 267%

Search Growth Status: Peak

Year founded: 2014

Location: Santa Cruz, California

Funding: $79.5M (Series Unknown)

What they do: MakerDao brands itself as a decentralized autonomous organization that uses the world’s first “impartial currency” called Dai. Maker is an entire ecosystem where holders of Dai can vote on changes to the Maker protocol itself (the code underlying it), borrow money by putting up Dai as collateral, and use a wallet called Oasis to store virtual currencies .

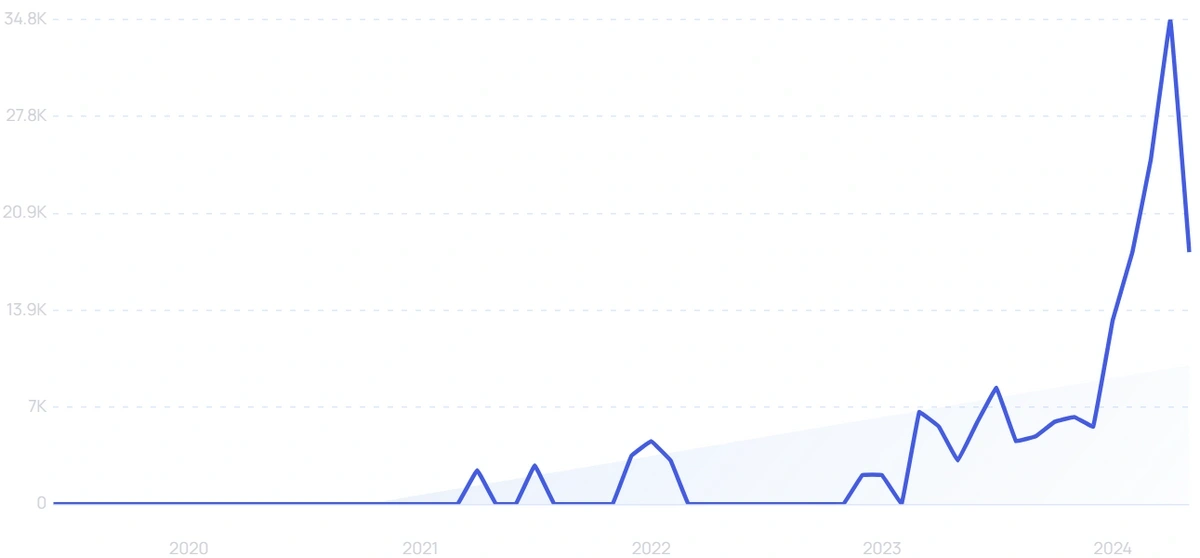

12. Pump.fun

5-year search growth: 456%

Search Growth Status: Exploding

Year founded: 2024

Location: United States

Funding: Undisclosed

What they do: Pump.fun is a meme coin development platform. Users can create and launch new meme coins for about 0.02 SOL (about $3.50) without any coding or technical skills. The platform stands out because all tokens are launched without pre-sales or team allocations, which distributes tokens fairly to help prevent kickbacks and scams.

13. 1 Inch

5-year search growth: 107%

Search Growth Status: Regular

Year founded: 2020

Location: Moon, Virginia

Funding: $189.8M (Series B)

What they do: 1Inch is almost brand new, and not much information exists, other than the fact that they are trying to create a new DeFi environment that contains several decentralized protocols within one environment. 1Inch will be governed by a DAO (Decentralized Autonomous Organization) where users get voting rights based on holding the 1Inch token. 1inch raised $175 million in their most recent Series B funding round.

14. Composite

5-year search growth: 97%

Search Growth Status: Regular

Year founded: 2017

Location: San Francisco, CA

Funding: $70.8M (Debt Financing)

What they do: Compound Finance is an open source interest rate protocol that works to bring new financial applications to the masses. As of today, there is almost $15 billion locked up in the Compound DeFi system. Users of Compound can earn interest ranging from 2%-8.5% by providing crypto to the ecosystem. As one of the biggest players in the space, Compound has been backed by major investors such as Andreeson Horowitz, Coinbase and Bain Capital.

15. Series

5-year search growth: 1.967%

Search Growth Status: Regular

Year Founded: San Francisco, California

Location: 2016

Funding: $33M (Series B)

What they do: Zerion is a cryptocurrency wallet for managing NFTs and DeFi assets. The platform consolidates over 60 DeFi protocols and offers features such as live price charts, trend investing and access to top liquidity pools and lending protocols. The startup has over 137,000 Discord members and over 341,000 active funded wallets.

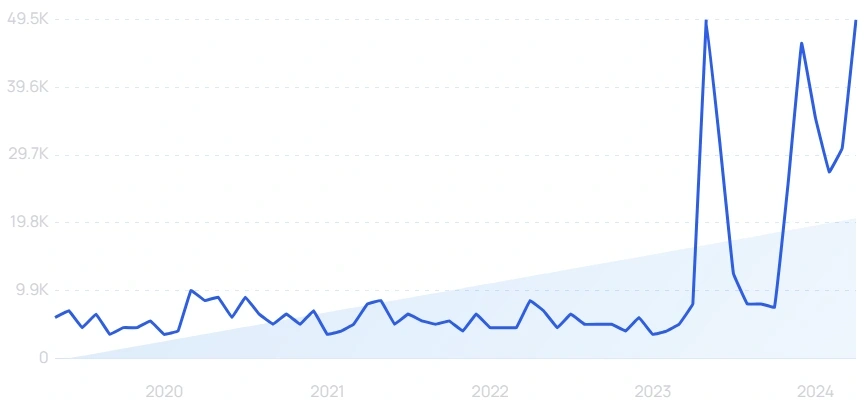

16. LayerZero

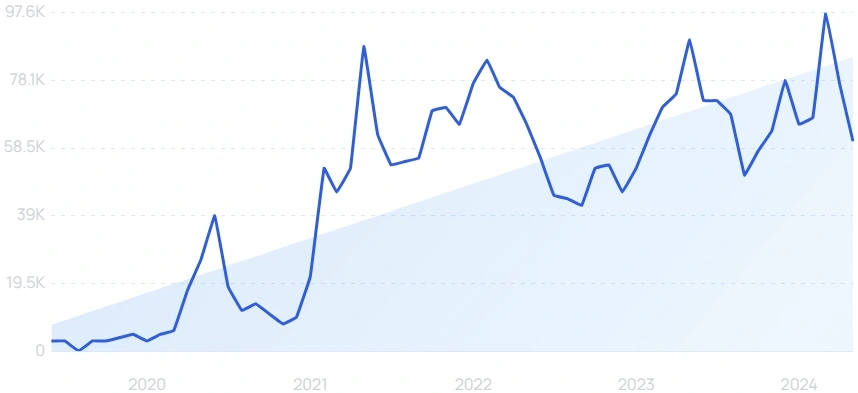

5-year search growth: 8,900%

Search Growth Status: Exploding

Year founded: 2021

Location: Vancouver, Canada

Funding: $293.3M (Secondary Market)

What they do: LayerZero is an omnichain interoperability protocol that allows assets to be transferred between 50 different blockchain networks. In 2023, the startup raised $120 million at a $3 billion valuation.

17. Sender wallet

5-year search growth: 4,100%

Search Growth Status: Regular

Year founded: 2022

Location: Singapore, Singapore

Funding: $4.5 million (seed)

What they do: Sender Wallet is a non-custodial DeFi wallet built primarily for the NEAR protocol. The wallet also supports Ethereum, BNB Smart Chain, Aurora, Avalanche, Polygon and 15 more compatible blockchains. The Sender Wallet app has over 100,000 downloads on the Google Play Store.

18. Raydium

5-year search growth: 4,100%

Search Growth Status: Regular

Year founded: 2020

Location: Singapore, Singapore

Funding: not disclosed (convertible note)

What they do: Raydium is a decentralized exchange built on the Solana blockchain. Customers can use the platform to process fast, low-cost transactions. The startup also allows users to perform token swaps using liquidity pools. Raydium’s token (RAY) currently has a market cap of $387.5 billion.

19. ChainLink

5-year search growth: 4%

Search Growth Status: Peak

Year founded: 2014

Location: Grand Cayman, Cayman Islands

Funding: $32M (Initial Coin Offering)

What they do: Chainlink works as one of the essential gears in the DeFi system. To have a decentralized financial system, you need accurate, reliable and up-to-date information about prices and asset movements.

Chainlink is an oracle, or intermediary, between complex smart contracts and allows them to work together. Seemingly unrelated smart contracts can be connected using Chainlink.

Closure

So there you have it. Our list of 19 fast-growing DeFi startups that are changing perceptions about what money really is and what it can do.

These DeFi startups all have a tight user experience about their products, sleek branding and marketing, but above all, a whole new way to move money in the digital age.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news