[ad_1]

Bitcoin is challenging the age-old allure of gold. As these two titans of value vie for dominance, the future of mining both assets is at a crossroads.

Gold, with its long history, symbolizes traditional wealth. Bitcoin, on the other hand, represents the cutting edge of digital innovation.

Gold vs Bitcoin: Which is Better?

Gold mining has stood the test of time. For centuries it was a symbol of wealth and stability. The process of extracting gold from the earth is labor intensive and environmentally taxing. Yet it remains a cornerstone of the global economy.

Gold’s tangible nature and historical significance make it a reliable store of value, especially during economic uncertainty.

In stark contrast, Bitcoin mining represents the cutting edge of digital innovation. It involves solving mathematical problems to validate transactions on the blockchain, a decentralized ledger. This process, known as Proof-of-Work (PoW), requires significant computing power and consequently large amounts of energy.

Gryphon Digital Mining CEO Rob Chang told BeInCrypto about Bitcoin miners’ strategic approach. He emphasized that Bitcoin mining can stabilize local networks and support renewable energy projects, providing a unique advantage that traditional gold mining lacks.

“Miners are looking for low-cost power, usually in areas with low demand or where there may not even be enough demand to support a stable network. The presence of a Bitcoin miner that uses consistent amounts of power is beneficial for regions where the local area may not have the demand to justify a stable network,” Chang said.

Both gold and Bitcoin mining have significant environmental footprints. Gold mining often leads to deforestation, water pollution and habitat destruction. Efforts to mitigate these effects include stricter regulations and the development of more sustainable practices.

However, the inherently physical nature of gold mining poses ongoing environmental challenges.

Bitcoin mining, on the other hand, is criticized for its high energy consumption. Although Bitcoin’s carbon footprint has come under scrutiny, the industry is increasingly turning to renewable energy sources.

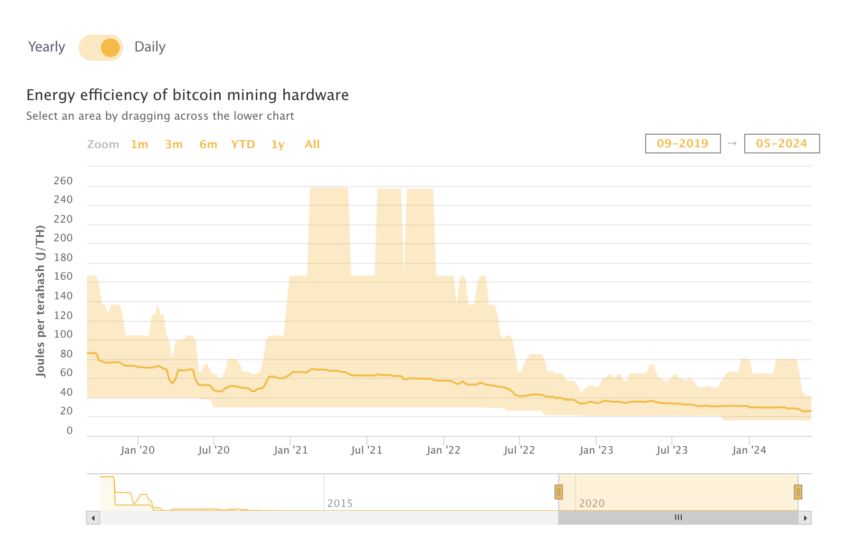

Chang noted that Bitcoin mining’s competitive nature drives efficiency and innovation, which can lead to more sustainable practices over time.

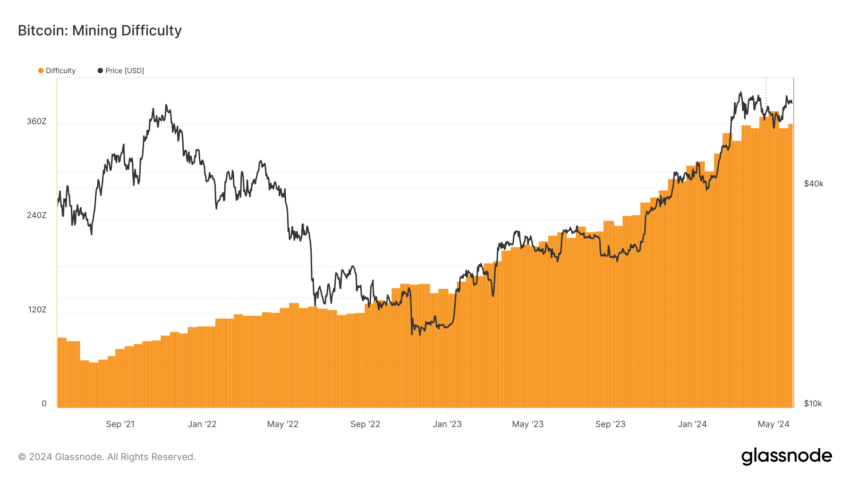

“Bitcoin mining problems are an inevitable outcome of Bitcoin’s success and are something miners should expect and in fact embrace, as they will only occur if Bitcoin continues to succeed. It incentivizes miners to be as efficient as possible and to innovate to stay as low cost as possible,” Chang added.

Read more: Free Cloud Mining Providers to Mine Bitcoin in 2024

Competitive mining market for both assets

The economic viability of mining operations is crucial for both industries. Gold’s value is affected by geopolitical stability, currency fluctuations and market demand. Despite its stability, the profitability of gold mining can be affected by fluctuating ore grades and increasing production costs.

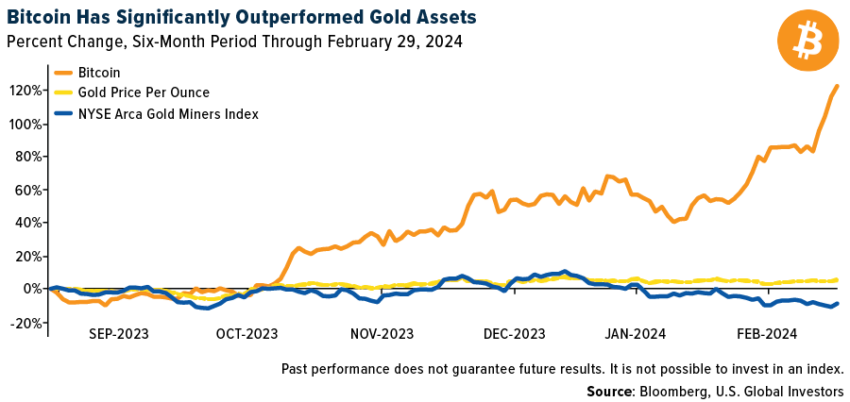

Bitcoin’s market dynamics are even more volatile. Its value is subject to market sentiment, regulatory changes and technological advances.

Chang explained that energy prices are the most critical cost variable for Bitcoin miners. Effective energy management can make or break a mining operation.

“The best measure of this is the Bitcoin efficiency ratio, which measures the amount of Bitcoin generated per exahash deployed. A good way to think about this is that Bitcoin is oil like hashrate is to oil rigs. The more exasashes or oil rigs a company has, the more Bitcoin or oil they need to generate,” Chang told BeInCrypto.

Read more: Top countries where you can legally mine Bitcoin

Furthermore, hardware competition at the ASIC miner level is welcome and good for the industry. Historically, a few dominant players controlled the mining machine market and squeezed profitability by repricing equipment based on real-time Bitcoin prices. This has made it difficult for miners to compete, as most are forced to provide large upfront payments to purchase machines.

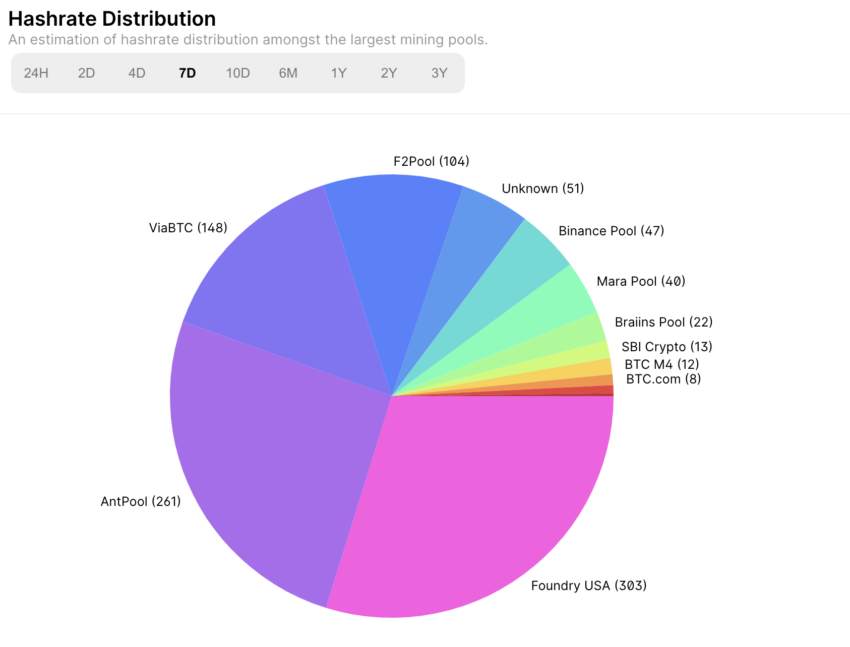

The centralization of mining power is a potential concern for the Bitcoin network. While this is not currently a problem, vigilance is needed to prevent bad actors from gaining control of the global hashrate. Decentralization is key to ensuring a secure blockchain.

Regulations also play a crucial role in the future of mining. Poor political environments can kill mining operations completely. Chang pointed out that most laws affecting Bitcoin mining are related to its energy consumption.

If a miner is carbon neutral, they can avoid regulations targeting carbon emitting operations.

Read more: 5 Best Platforms to Buy Bitcoin Mining Shares Before 2024 Halving

Looking ahead, gold will remain a safe-haven asset, but its environmental impact could drive tighter regulations and push for greener mining technologies. With its potential to support renewable energy and stabilize grids, Bitcoin could pave the way for a more sustainable future in digital asset mining.

Disclaimer

Following the Trust Project guidelines, this article presents opinions and perspectives from experts or individuals in the industry. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news