Many useful indicators can help you when trading crypto, and the Relative Strength Index is one of them.

You need a combination of various analytical tools and indicators to trade crypto successfully. One such indicator is the relative strength index (RSI). The RSI is one of the most popular indicators used by day traders, and using it correctly will make it a valuable tool in your trading arsenal.

So, what is the relative strength index, and how can you use it in your crypto trades?

What is the RSI?

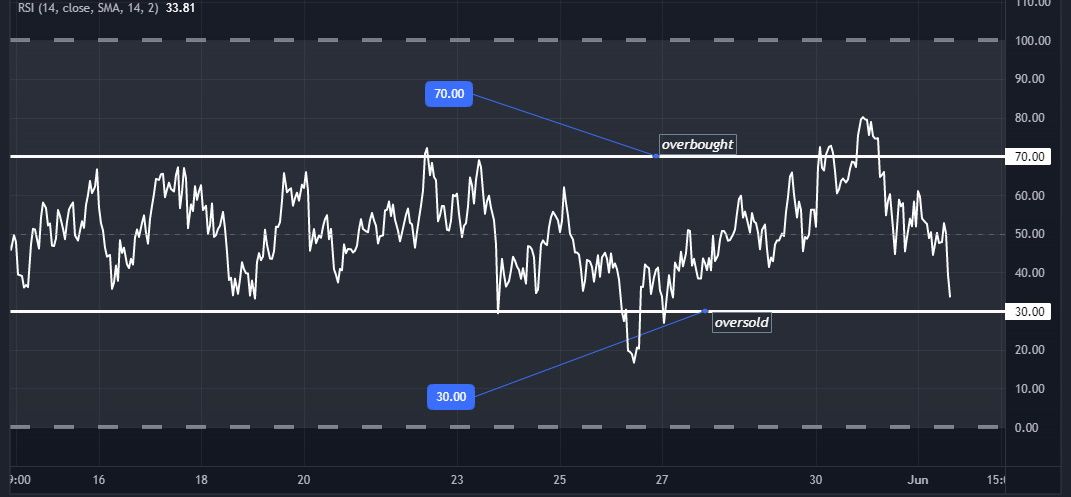

The RSI is a momentum indicator used in technical analysis. This indicator examines the magnitude of recent price movements to determine whether or not the price of a cryptocurrency is overbought or oversold.

The momentum oscillator, a line chart that oscillates between two extremes, reads anywhere from 0 to 100. J. Welles Wilder invented it in his groundbreaking book New Concepts in Technical Trading Systems, published in 1978.

How the RSI works

The RSI analyzes whether a crypto’s price is overbought or oversold by measuring the size of recent price movements, using a formula to calculate overbought and oversold positions.

RSI Formula

The RSI is calculated using the following formula: RSI = 100 – (100 / [1 + RSI]), where RSI equals the average gains from up periods during the specified period divided by the average losses from down periods during the specified period.

You don’t need to worry about calculating the RSI value of any crypto yourself; the indicator on exchange platforms does all the calculations for you. All you have to do is enter the necessary data.

Overbought and oversold positions

A crypto asset is said to be overbought when the RSI is above 70. At this point, the bullish trend is due for a correction. On the other hand, when it is below 30, the price is considered oversold due to a pullback.

In a strong uptrend, the relative strength index will frequently reach 70 or even higher for extended periods, while in a downtrend it may stay at 30 or lower for a long time. Traders can use the RSI to determine when to buy at oversold levels in a bullish trend. However, in a bearish trend, they look for selling opportunities when the price is overbought.

RSI level above 50 indicates more buying momentum and shows stronger buying power in the market. On the other hand, a reading below 50 indicates more bearish power. You can always analyze the price activity around the 50 level to know when a bullish or bearish trend is about to change.

RSI divergence

A price divergence on the relative strength index occurs when a crypto price reaches a new high or drops to a new low, but the RSI does not form a corresponding new high or low.

The RSI divergence comes in two forms, the bearish and the bullish divergence. A bearish divergence forms when the price of a coin makes a new high while the RSI makes a new low. In this case, the RSI does not confirm the new high, indicating that price momentum has declined. A bullish divergence occurs when the price makes a new low, but the RSI value does not. This phenomenon is taken as a buy signal.

In the chart above, the price moved upwards, and at the same time the corresponding RSI value moved in the opposite direction. In other words, the price continued to show a bullish trend while the RSI showed a bearish trend. Traders usually interpret this signal as a weakening of the ongoing bullish momentum, which may cause a change in trend.

The bullish divergence occurs just like in the chart below: the price continued to fall, but the RSI started to reduce the selling momentum (indicated by the rising RSI level). Traders start expecting a bullish reversal at such a point.

When using the RSI, traders look for the following:

Buying opportunities at oversold positions (when the RSI value is 30 and below) Buying opportunities in a bullish trend (when the RSi is above 50 but below 70) Buying opportunities during a bullish reversal (in a bullish divergence) Selling opportunities at overbought positions ( when the RSI value is 70 and above) Selling opportunities in a bearish trend (when the RSI value is below 50 but above 30) Selling opportunities during a bearish reversal (in a bearish divergence)

Limitations of the RSI

Despite its value to crypto traders, the RSI has its limitations.

The RSI is not good enough to confirm trade entries

The relative strength index is best applied as a preliminary indicator that alerts traders to trading opportunities that should be subjected to further analysis. It is not a good idea to use it as a stand-alone indicator as it will result in unfavorable trading results. When used on its own, the RSI identifies overbought and oversold conditions.

However, it does not indicate whether such a condition is good for trade execution.

The RSI can be misleading if a trend is strong

Even though it has been established that the RSI can be used to predict price reversals, the RSI cannot determine when such reversals will occur. As a result, it may remain overbought or oversold for longer than you originally expected. This can continue for several days in higher time frames, especially those using long-term crypto trading strategies.

Use the RSI with other technical indicators

Even though the relative strength index (RSI) can alleviate some of the stress that comes with decision making, you should never rely solely on it. Keep in mind that there is no guarantee that the RSI will work in every situation. Therefore, it is good to include more indicators to confirm your trading decisions.

Successful traders using the RSI combine it with indicators such as the moving average convergence divergence (MACD), simple and exponential moving averages, and many other technical indicators to confirm RSI signals.

The Relative Strength Index (RSI) is a powerful tool for day traders. But of course you shouldn’t put too much faith in it because the outcome is never certain. A prediction made by the RSI is nothing more than an interpretation of the past data and has very little to do with the present or the future.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news