ONDO has seen a significant 15% surge following Bitcoin’s rise to $69,500, with a 19% price increase since the start of the week.

Over the past two days, Ondo (ONDO) has experienced a remarkable surge in chain activity, indicating a potential bullish trend.

ONDO Rises on Bullish Bitcoin Price Action

ONDO registered a significant 15% surge after Bitcoin’s rise to $69,500. Notably, ONDO’s price has risen by 19% since the start of the week. Examining the daily chart, it is clear that ONDO has established a support level at $1.17, testing the Ichimoku baseline (red).

While the price of ONDO saw significant gains in June, it also saw additional growth through on-chain transaction volume, as Juan Pellicer, Senior Researcher at InToTheBlock, said.

“Since early May, Ondo Finance has experienced a significant increase in on-chain transaction volume, now exceeding $120 million weekly. It outperforms all other RWA protocols. This shows that the rising prices of the token are not simply based on speculation, but also reflect real usage.” Pellicer commented.

Furthermore, the Ichimoku baseline, a critical indicator for predicting price movements, serves as both support and resistance. A test of this baseline is typically considered a reversal signal.

Currently, ONDO is trading 58% above its 100-day exponential moving average (EMA, in blue), a strong bullish indicator. Importantly, the 100 EMA showed no flattening trend even though ONDO underwent a 21% price correction from its peak of $1.48 to $1.17.

Read more: Learn more about Real-World Assets (RWA) as ONDO positions itself as an RWA project.

The fact that the EMA has remained steady, coupled with the price action above the baseline, indicates that ONDO is poised to continue its upward trajectory towards its all-time high.

If ONDO falls back below the Ichimoku baseline shown in red, it may indicate a bearish trend for the price. Placing stop losses below this level can be a prudent strategy to reduce risks when trading similar high-volatility cryptocurrencies.

Key On-Chain Indicators Signal Bullish Momentum

The past two days have seen a significant increase in on-chain activity for the Ondo token.

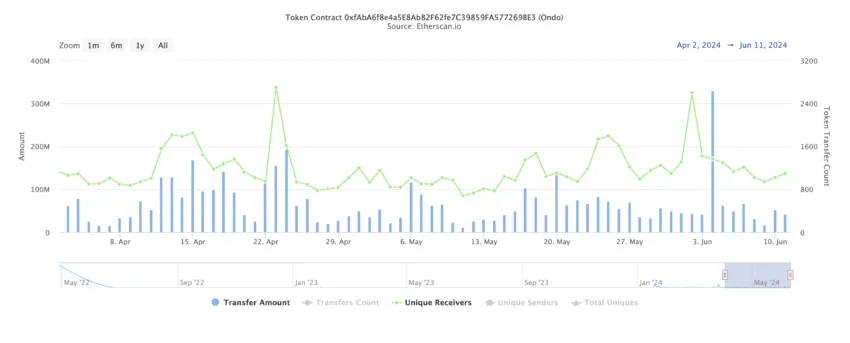

Key indicators such as Unique Recipients (Receiving Addresses) and Transfer Amounts have increased markedly. This increase indicates growing interest and engagement in the token, possibly indicating a shift in market dynamics or investor sentiment.

A closer look at the unique recipients reveals that more addresses received ONDO during the past two days. This may indicate the expansion of acceptance and demand. The increase in unique recipients is a positive sign, suggesting that the token is gaining traction and attracting a broader user base.

The increase observed in unique recipients (June 4), which reached 2,600, was a clear indication of the token’s price surge. Monitoring this indicator is essential for identifying potential long positions on ONDO.

Read more: Ondo (ONDO) Price Forecast

Likewise, the transfer amounts increased (Blue bars), indicating higher transaction volumes. This could be due to larger individual transactions or an overall increase in the number of transactions.

Higher transfer amounts often reflect greater liquidity and market activity, which can be driven by positive news, developments or speculative trading. These trends indicate a bullish sentiment among investors, highlighting the importance of monitoring these indicators for future market insights.

The observed trends indicate a bullish outlook for the ONDO token, suggesting that the price may reach its peak of $1.48 sooner than expected.

ONDO’s Price Prediction: During its all-time high, ONDO’s market cap reached $2 billion. If ONDO continues to break its all-time high, the market cap could target $2.5 billion, which corresponds to a 25% price appreciation from the all-time high, making $1.88 a potential profit point. A further target is a market cap of $3 billion, a 50% increase, making $2.30 an additional profit level for long-term holders.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news