In 2021, the cryptocurrency market regained public attention as the value of one Bitcoin broke through its previous peak of nearly $20,000 to reach a price of nearly $70,000.

However, in 2022, the market suffered numerous high-profile failures, including the collapse in value of stablecoin provider Terra’s UST and the collapse of crypto exchange FTX. By 2024, the effects of those events and others, and the subsequent bear market (in which many cryptocurrencies fell 90% from their highs), meant that crypto once again disappeared from the average person’s consciousness.

Although sentiment turned positive as Bitcoin recovered and crossed $70,000 again in March 2024, driven by the approval of Bitcoin ETFs (which allow investment in futures contracts rather than cryptocurrency itself), concerns about the market still remain with many. These concerns have been exacerbated by pending government regulations designed to limit cryptocurrency growth, such as the Securities and Exchange Commission’s litigation efforts that classify many cryptocurrencies as securities.

The regulator filed lawsuits against 31 crypto firms it accused of violating US securities law. Although the SEC ended one of its investigations in June, given the crypto sector’s turbulent history, it is not surprising that many in the travel industry have dismissed cryptocurrency as a passing fad, as they did after the comparable 2017 crypto- and blockchain hype bubble burst.

Get a dose of digital travel in your inbox every day

Subscribe to our newsletter below

However, flying under the typical travel industry radar is the fact that the central banks of many countries have begun to issue their own digital currencies. These central bank digital currencies (CBDCs) have characteristics similar to cryptocurrencies, but with one critical difference: In contrast to the decentralized nature of many cryptocurrencies, with Bitcoin being the prime example, CBDCs are fully centralized and have been created, promoted and controlled by existing central banks. For more on centralization versus decentralization, see The Decentralized Computing Future (2021).

The purpose of a CBDC is to act as a digital version of a country’s currency. As few travel providers and retailers currently accept digital currency, the introduction of government-sponsored digital currency adds a new wrinkle to the types of payments that must be accepted.

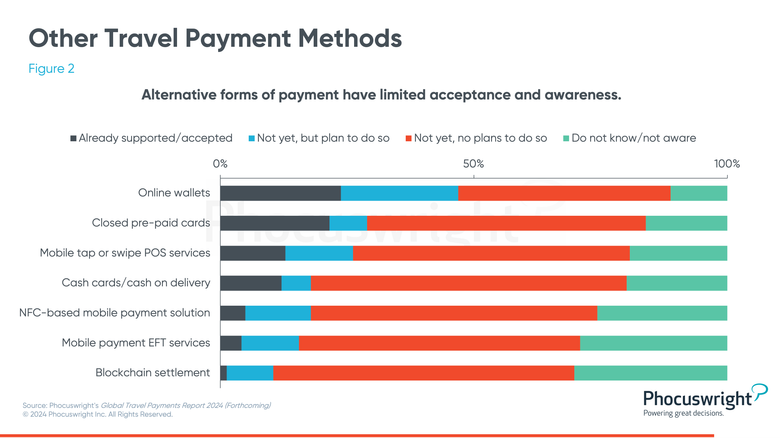

Phocuswright’s forthcoming Global Travel Payments Report 2024 illustrates the lag in adoption of digital currencies, with seven out of 10 travel companies having no plans to accept them.

CBDC’s impact on the travel industry

To be successful, CBDCs must fit within the current payments infrastructure. A central bank can issue this digital money to financial institutions for distribution, or even directly to a consumer’s digital wallet.

The consumer will pay at the checkout the same way they do with a phone today. The only caveat is that the wallet required for this transaction must be a software wallet that stores value.

For a description of wallet types, see Who Owns the Client? How are the customers themselves! The article also addresses the need for software wallets to hold self-sovereign identity (SSI) profiles. If CBDCs proliferate, this could also serve as a means for greater distribution of software wallets.

To prepare for the rise of CBDCs, travel companies must:

Assess global markets, recognize those advancing their CBDC roster and analyze its impact on travel payment strategies. Join working groups such as the European Central Bank’s “Call for candidates to participate in the digital euro scheme infrastructure-related requirements work stream.” Assign a team or individual to be educated about CBDCs, track their progress and contribute to a strategy for CBDC adoption based on overall market acceptance.

While consumer adoption of digital currencies has been slow to date, the full deployment of CBDCs in the coming years means that most consumers will have access to digital currency as a form of payment.

The travel industry is currently struggling with alternative forms of payment, so the move to full digital currencies, even those provided by the government, will require broad industry cooperation. In Phocuswright’s forthcoming Global Travel Payments Report 2024, travel companies of all sizes and in various geographies show resistance to the adoption of alternative forms of payment (AFPs), although global adoption is growing in other industries.

The dust has not settled on the CBDC issue, but it is clear that various governments are continuing their CBDC efforts and preparations must be made.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news