Bitcoin price is a rollercoaster ride, with its value experiencing wild swings over the years. For those interested in the leading cryptocurrency, it is essential to understand the factors that influence its price.

These top seven factors affecting Bitcoin price can provide investors with the insights needed to make informed decisions.

Bitcoin Supply and Demand

Market adoption

As with any commodity or currency, the forces of supply and demand play a crucial role in determining BTC price.

As more people embrace Bitcoin for transactions, investments, or simply as a store of value, demand for digital currency increases, driving up its price. Conversely, if the need for Bitcoin decreases, its value is likely to decrease.

Bitcoin mining and halving

Bitcoin’s supply is limited to 21 million, meaning that a finite number of coins are available. Miners generate new bitcoins through mining, which becomes increasingly difficult over time.

In addition, the Bitcoin halving event, which occurs approximately every four years, reduces the number of new coins entering the market by 50%. These factors contribute to supply constraints, which can affect the price of BTC.

Bitcoin market sentiment

News and Public Opinion

News and public opinion play an important role in shaping market sentiment and influencing the price of Bitcoin.

Positive news, such as increased adoption by large companies or favorable regulatory developments, can increase prices. Conversely, negative news, such as security breaches or unfavorable regulations, can trigger a sell-off, driving the price down.

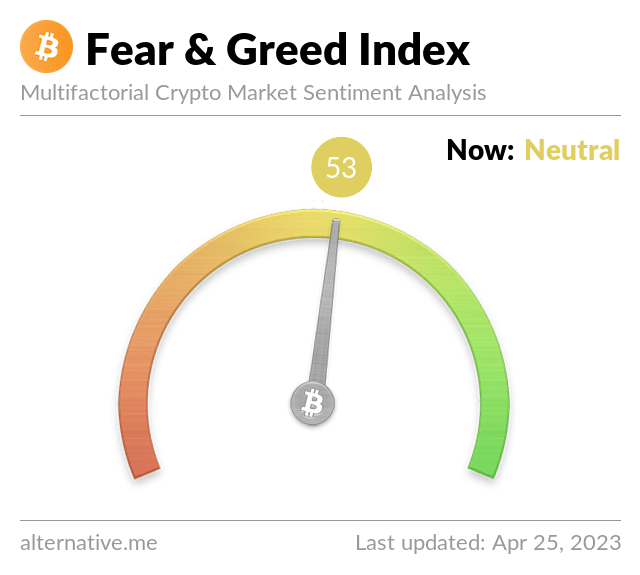

Fear and greed

Emotions are another important driver of Bitcoin price and one of the most important. Fear and greed often lead to market overreactions, causing rapid price swings.

When the market is optimistic and greedy, people can buy more BTC, driving the price up. However, when fear and panic sets in, investors may rush to sell their holdings, leading to a sharp drop in price.

Institutional interest in Bitcoin

Large institutions, such as banks, hedge funds and other financial entities, can significantly influence Bitcoin price.

As these institutions increasingly invest in and adopt Bitcoin, the price may rise due to its increased demand and credibility as the leading cryptocurrency.

Regulatory Environment

Governments and regulatory bodies play an important role in shaping the future of cryptocurrencies like Bitcoin.

Positive regulations, such as legalizing Bitcoin or creating clear guidelines, can encourage adoption and drive its price. On the other hand, strict regulations or outright bans can hinder its growth and negatively affect its value.

Bitcoin Technological Developments

Scalability solutions

One of the challenges facing Bitcoin is its ability to handle a large volume of transactions. Scalability solutions like the Lightning Network aim to address this problem by enabling faster and more efficient transactions.

As these solutions mature and are adopted, they can positively impact the price of Bitcoin by increasing its utility and driving greater demand.

Security improvements

The security of the Bitcoin network is crucial to maintaining trust in the digital currency.

As new security measures and technologies are implemented, this can contribute to a more secure network and boost trust in Bitcoin. This, in turn, can positively affect its price.

Geopolitical events

Geopolitical events, such as economic crises, political instability or global tensions, can affect the price of Bitcoin.

In times of uncertainty, people may turn to Bitcoin as a safe-haven asset, increasing its value. Conversely, if global events lead to increased scrutiny or regulation of cryptocurrencies, this could negatively impact the Bitcoin price.

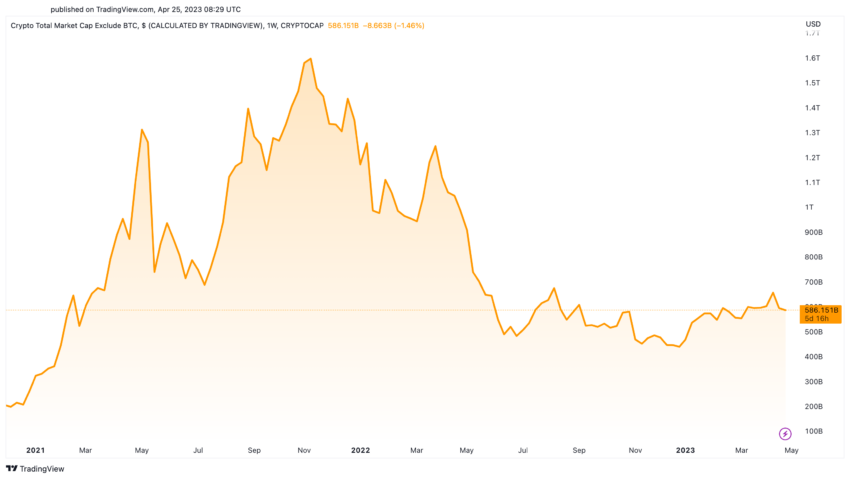

Competing Cryptos

The rise of competing cryptocurrencies, also known as altcoins, can affect the price of Bitcoin. As new coins enter the market, they can draw attention and investment away from Bitcoin.

However, Bitcoin’s status as the original and best-known cryptocurrency can also benefit its price, as it often serves as a gateway for investors entering the crypto market.

Bitcoin price managers

Understanding the many factors that affect Bitcoin’s price can help investors make more informed decisions when investing or trading in cryptocurrencies.

By considering the impact of supply and demand, market sentiment, institutional interest, regulatory environment, technological developments, geopolitical events and competing cryptocurrencies, investors can better anticipate potential price movements and position themselves accordingly.

In compliance with the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, designed to extract, analyze and organize information from a wide variety of sources. It works without personal beliefs, emotions or biases, providing data-centric content. To ensure relevance, accuracy and adherence to BeInCrypto’s editorial standards, a human editor carefully reviewed, edited and approved the article for publication.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news