Most people know Crypto.com as an exchange and wallet app that competes with the likes of Kraken and Coinbase with a series of high-profile ad campaigns. This includes commercials with Matt Damon, a Superbowl halftime spot with Lebron James, and naming rights to the former Staples Center.

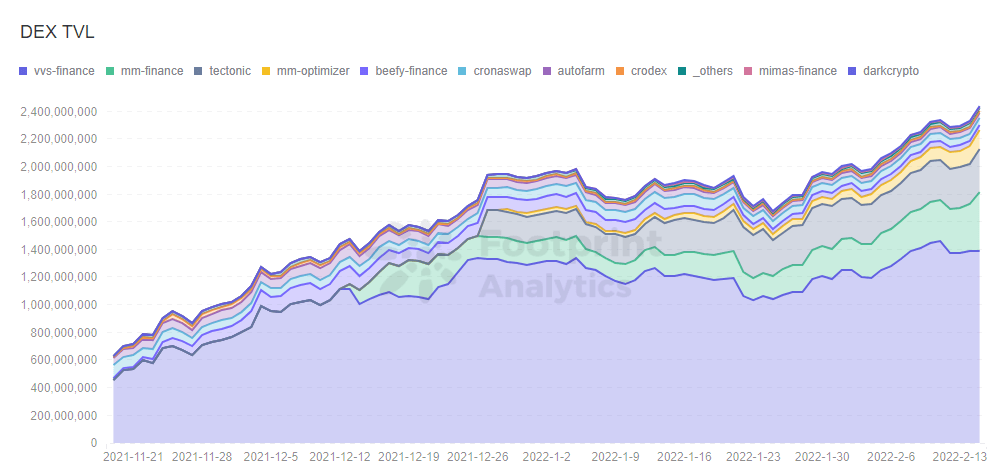

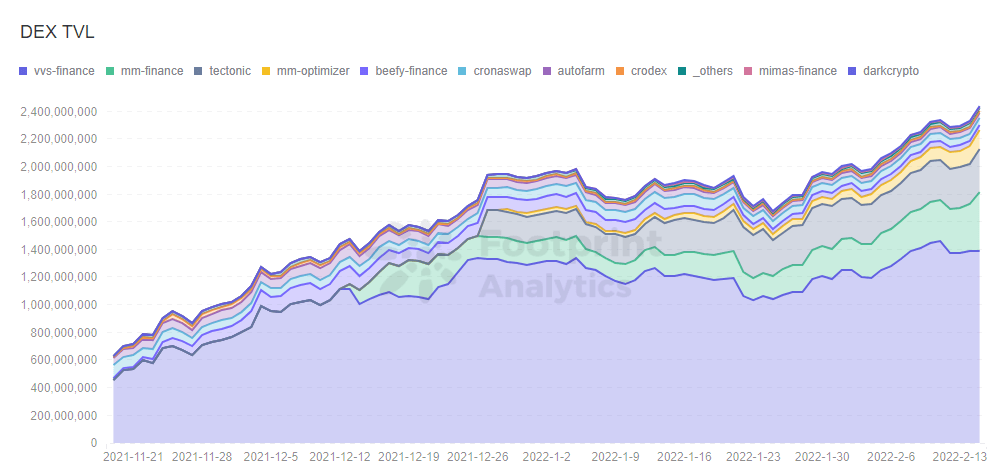

However, the Singapore-based company has done much more since launching Cronos, an EVM-compatible blockchain whose DeFi ecosystem has steadily grown to $2.3 billion in TVL since going live in November.

VVS protocol is the largest project on the Cronos chain and takes 59% of its total TVL on February 15th. It is already the 7th largest DEX by TVL, currently behind Trader Joe’s and just ahead of Osmosis.

What is VVS Finance?

VVS Finance is a DEX that offers the usual DeFi capabilities: swaps, liquidity pools and staking.

It stands for Very, Very Simple Finance, which makes its UVP clear – the platform aims to simplify DeFi. It does this through gamification and an easy-to-use interface.

It also checks many of the boxes that Footprint recommends you look at when assessing the health of a crypto project:

Substantial initial market capitalization: VVS Finance’s market capitalization jumped from $20 million to $170 million in the first few months since its launch and has largely mirrored the general market trend since then. Reasonable trading volume: VVS Finance’s trading volume mostly stayed between 5%. and 20% of its market capitalization. Price Action: The price action of the protocol’s token VVS is about as volatile as you would expect from a new DEX project and a new chain, but with no suspicious pumps.

So why has the first AMM on Cronos and a potential contender to be the next SushiSwap or PancakeSwap sparked so much controversy recently?

VVS Finance’s Tokenomics is questionable

VVS’s total circulating supply is 2.2 trillion, and its total supply is over 36 trillion, which will increase to 100 trillion over ten years through its emission schedule.

For comparison, here are the top DEX tokens’ circulating supply figures (rounded to a million).

SushiSwap: 127 million SUSHIUniswap: 632 million UNIPancakeswap: 268 million CAKEBalancer: 7 million BAL

As the only major DEX token that is so inflationary (note that CAKE has no hard cap, but deflationary mechanisms to keep supply under control), VVS Finance’s tokenomics model is an outlier.

Here are some reasonable critiques from one self-proclaimed holder, dsx02, on Reddit:

“I held both VVS and TONIC but sold both when I looked at the Tokenomics, they are really bad 100 billion stock of VVS and 500 billion of TONIC, to put it into perspective that’s 1000x more VVS than what is there DOGE and DOGE is already a wildly inflated coin whose price is suffering tremendously for it… and they plan to issue HALF (50 billion) in 2022 alone so yeah i [sic] really don’t see how it’s going to go up in value unless you just don’t believe in inflation at all.”

But does VVS’ incredibly high token supply matter to its long-term potential?

While 100 billion is enormous, other tokens have significantly higher, or even unlimited, supplies, including Ethereum.

Previously mentioned CAKE has an unlimited total supply.

Thus, the total supply is not the key measure of a project’s quality, advantages or disadvantages. What is important is how they will be distributed—according to which business model. If there is too much stock circulating but not enough being used (eg through stabbing or burning), this will affect its token price and intrinsic value.

If VVS Finance can maintain its top position in the Cronos ecosystem, and Cronos can continue to increase its activity, the project – which is intrinsically linked to the potential of Crypto.com – could be a good investment.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Mentioned in this article

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news