Gary Gensler’s tenure as chairman of the US Securities and Exchange Commission (SEC) has been marked by fierce opposition to the cryptocurrency industry, making him a key antagonist in the sector.

However, with his term expiring in 2026 and the upcoming 2024 election potentially leading to a change in leadership, many in the crypto world expect a shift away from his app-heavy approach.

Gensler’s tenure began in 2021, during which he made the crucial decision that no new rules for crypto regulation were necessary. Instead, he relied on existing securities laws, particularly the Howey test from the 1940s, to crack down on crypto companies through legal action. This has led to an enforcement-oriented regulatory style, which critics say leaves the industry in the dark, fosters confusion and stifles innovation. Gensler’s refusal to adjust regulations for digital assets has frustrated industry players and lawmakers alike.

Congress has also been involved, with the House passing a bill to create crypto-specific rules, though it has yet to pass the Senate. Meanwhile, the SEC has faced resistance from lawmakers, including a majority vote in the Senate to reverse an SEC crypto-accounting policy. Next year’s Congress is likely to be even more involved in crypto matters, especially with members receiving significant financial support from the industry.

Trump will likely show Gary the door

If Donald Trump wins the 2024 election, Gensler’s retirement could be accelerated, as Trump has promised to fire him. Even if Gensler doesn’t step down immediately, a Trump victory would likely lead to his eventual replacement by a more crypto-friendly commissioner, such as Hester Peirce, a strong advocate for the industry. Conversely, if Vice President Kamala Harris wins, Gensler’s departure may be less urgent, although her administration is expected to take a less antagonistic approach to crypto.

At Bitcoin Nashville earlier this year, Trump said: “On day one, I will fire Gary Gensler and appoint a new SEC chairman,” Trump said as the crowd went wild. “I didn’t know he was so unpopular. Let me say it again. On day one I will fire Gary Gensler.”

Source: X

To Gary’s credit, he gave us Crypto ETFs (reluctantly)

Despite the controversies surrounding Gensler’s approach, some see him as a key figure in the legitimization of cryptocurrency, especially after his role in approving spot bitcoin exchange-traded funds (ETFs), a move seen as significant for the mainstream acceptance of digital assets. His legacy in the crypto world may ultimately reflect both his strong regulatory stance and his unexpected contributions to the industry’s mainstream adoption.

The SEC’s ETF Approvals in Januarywhile expected due to legal and market pressure, still came as something of a surprise due to the agency’s historical wariness of crypto investments. Since taking office, SEC Chairman Gary Gensler has been particularly vocal about the risks associated with investing in crypto, frequently linking the asset class to fraud and scams.

Despite his public skepticism, Gensler was one of three commissioners who approved the mock BTC ETF offerings. Gensler was likely the deciding vote, with the approval passing 3-2. Commissioners Hester Peirce and Mark Uyeda approved the ETFs with Gensler, while Caroline Crenshaw and Jaime Lizárraga dissented. This indicates how close the ETFs came to being rejected.

In a statement released after the ETFs were approvedGensler was clear that the SEC does “approve or endorse” Bitcoin despite the approval.

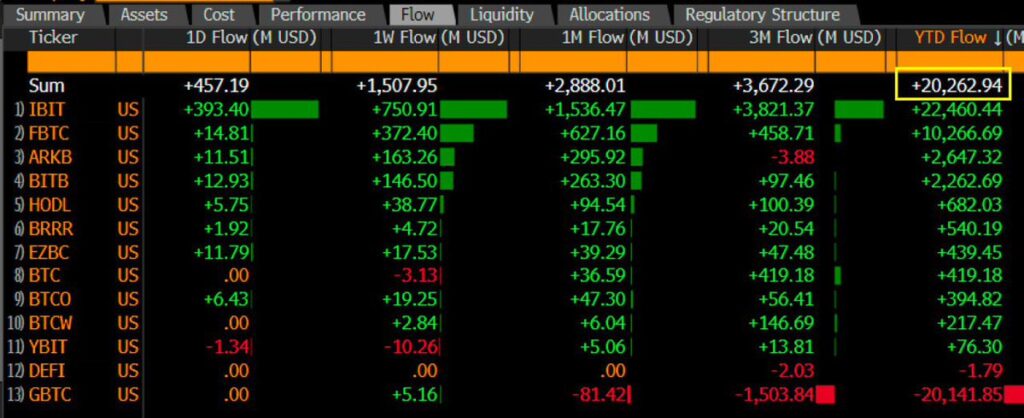

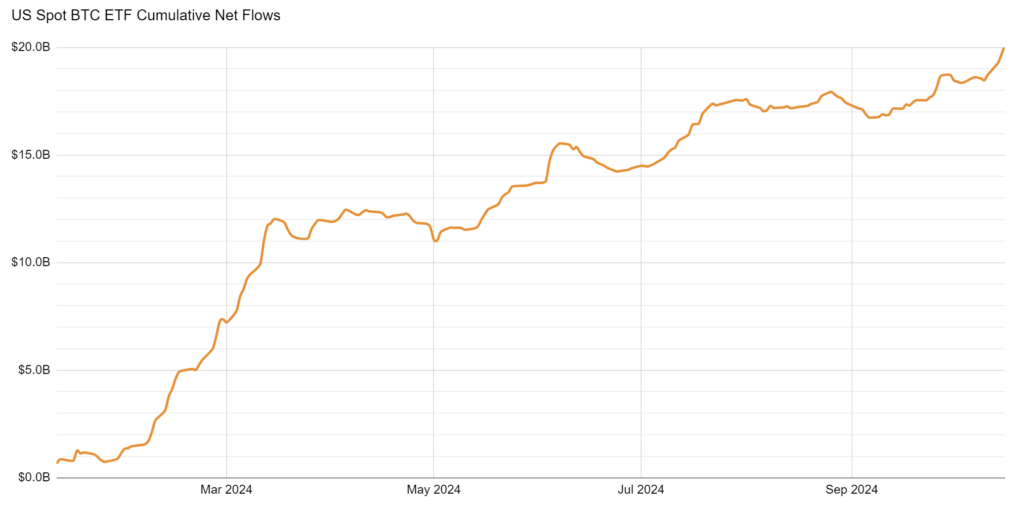

The ETFs have since become one of the most successful ETF launches ever, hits 20 billion.

Source: X

An Uncertain Future

The future of the SEC’s crypto regulation is uncertain, with the possibility of a new regulatory framework emerging under different leadership. Whether through Congressional action or a change in SEC leadership, the next few years could see a significant shift in how the US regulates digital assets. However, the challenges of creating new laws and dealing with ongoing court cases will likely remain for whoever succeeds Gensler at the helm.

Since taking over the SEC in 2021, Gary Gensler’s stance on cryptocurrencies has been anything but straightforward. His approach often leaves the industry with a sense of ambiguity. In a recent Oct. 22 interview on Bloomberg Business, Gensler sidestepped a direct question about the regulation of digital assets, instead offering a birthday nod to Bitcoin, which will turn 16 on Oct. 31, 2024, marking the release of its white paper in 2008 mark.

Gensler reiterated the SEC’s commitment to its current enforcement-based regulatory framework, citing the importance of protecting investors from potential risks in the volatile crypto market. “For nine decades, we have relied on strong laws passed by Congress and agency rules to protect investors and promote capital formation. We’re not changing it now,” Gensler asserted.

When probed about the possibility of Donald Trump winning the 2024 presidential election and the former president’s vow to fire him on his first day in office, Gensler declined to comment. Trump has promised to oust the SEC chairman and launch the World Liberty Financial project if elected, but Gensler has remained tight-lipped about his future under a potential Trump administration.

This interview came just after the SEC’s Division of Examinations announced its focus on crypto-assets as a top priority for 2025, signaling continued scrutiny of the industry. Despite widespread criticism from business leaders and lawmakers for his tough stance, Gensler shows no signs of backing down.

As of now, Bitcoin is trading at $67,462, enjoying a 6% price increase in the past month, but still unable to break $70,000.

Source: Brave New Coin Bitcoin Liquid Index

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news