This blog is a preview of our 2021 Geography of Cryptocurrency report. Register here to download the whole thing!

We are excited to share with you the 2021 Chainalysis Global Crypto Adoption Index. This is the second iteration of our efforts to measure grassroots cryptocurrency adoption around the world, following a year of huge growth for cryptocurrency markets and increased attention for the industry.

The purpose of our crypto index is to provide an objective measure of which countries have the highest levels of cryptocurrency adoption. One way to do this is to simply rank countries by transaction volume. However, this will only benefit the countries with high levels of professional and institutional cryptocurrency adoption, as those market segments move the largest amounts of cryptocurrency. While the professional and institutional markets are crucial, we want to highlight the countries with the largest cryptocurrency adoption by ordinary people, focusing on use cases related to transactions and individual savings, rather than trading and speculation.

Below, we’ll explain the index’s methodology and how it’s changed compared to last year before showing the top-ranked countries for cryptocurrency adoption, as well as some trends we’ve found interesting.

Our methodology

The Global Crypto Adoption Index consists of three metrics, which we will explain in detail below. We rank all 154 countries according to each of those three measures, take the geometric mean of each country’s ranking in all three, and then normalize that final number on a scale of 0 to 1 to give each country a score that represents the overall ranking determined. The closer the country’s final score is to 1, the higher the ranking.

On-chain cryptocurrency value received, weighted by purchasing power parity (PPP) per capita

The purpose of this metric is to rank each country by total cryptocurrency activity, but weight the rankings to favor countries where that amount is more significant, based on the wealth of the average person and value of money generally within the country.

We calculate the metric by estimating the total cryptocurrency received by that country, and weighting the chain value based on PPP per capita, which is a measure of the country’s wealth per inhabitant. The higher the ratio of on-chain value received to PPP per capita, the higher the ranking, meaning that if two countries received equal cryptocurrency value, the country with the lower PPP per capita would be ahead.

Intra-chain retail value transferred, weighted by PPP per capita

The purpose of this metric is to measure the activity of non-professional, individual cryptocurrency users, based on how much cryptocurrency they do compared to the wealth of the average person. We approximate individuals’ cryptocurrency activity by measuring the amount of cryptocurrency moved in retail transactions, which we designate as any transaction for cryptocurrency valued at less than $10,000 USD. We then rank each country according to this measure, but weight it to favor countries with a lower PPP per capita.

Peer-to-peer (P2P) exchange volume, weighted by PPP per capita and number of internet users

P2P trading volume makes up a significant percentage of all cryptocurrency activity, especially in emerging markets. For this index, we rank countries by their P2P trading volume and weight them to favor countries with lower PPP per capita and fewer internet users, with the aim of highlighting countries where more residents invest a greater proportion of their overall wealth in P2P – place cryptocurrency transactions. .

How our methodology changed in 2021

The biggest change to our methodology this year was the elimination of a fourth metric that contributed to each country’s overall ranking in 2020: Number of deposits per country weighted by number of Internet users.

We initially used this as a benchmark to determine which countries’ residents conduct the most cryptocurrency transactions, as it would both capture the number of individuals using cryptocurrency and boost countries whose residents conduct more transactions per user give. Although cryptocurrency deposits to centralized services such as exchanges appear on-chain, any transactions within those services, such as transactions within an exchange, are not captured on-chain, and only appear in those services’ order books, which we have in in some cases limited or even no access to.

However, this is not the case for DeFi. Transactions performed by DeFi protocol users all appear in the chain, as no centralized service ever manages users’ digital assets. This skewed our ranking towards countries with relatively more DeFi users. Therefore, after reviewing the rankings with and without this component, we decided to eliminate it. We also decided to create a new DeFi adoption index, which will be available in the coming weeks.

We are confident in our index methodology and the changes we made to it this year, although there are limitations, as with any standardized measure of local economic activity. Since we rely on web traffic data, the use of VPNs and other products that hide online activity will compromise our ability to accurately attribute activity to a country. However, our index takes into account hundreds of millions of transactions, so VPN use would have to be fairly widespread to significantly affect the data. Experts we spoke to agreed that the index matches their perception of the cryptocurrency market, giving us more confidence in the methodology. We look forward to continuing to adjust the index methodology to ensure that our rankings accommodate evolutions in the market and become more accurate over time.

The 2021 Global Crypto Adoption Index Top 20

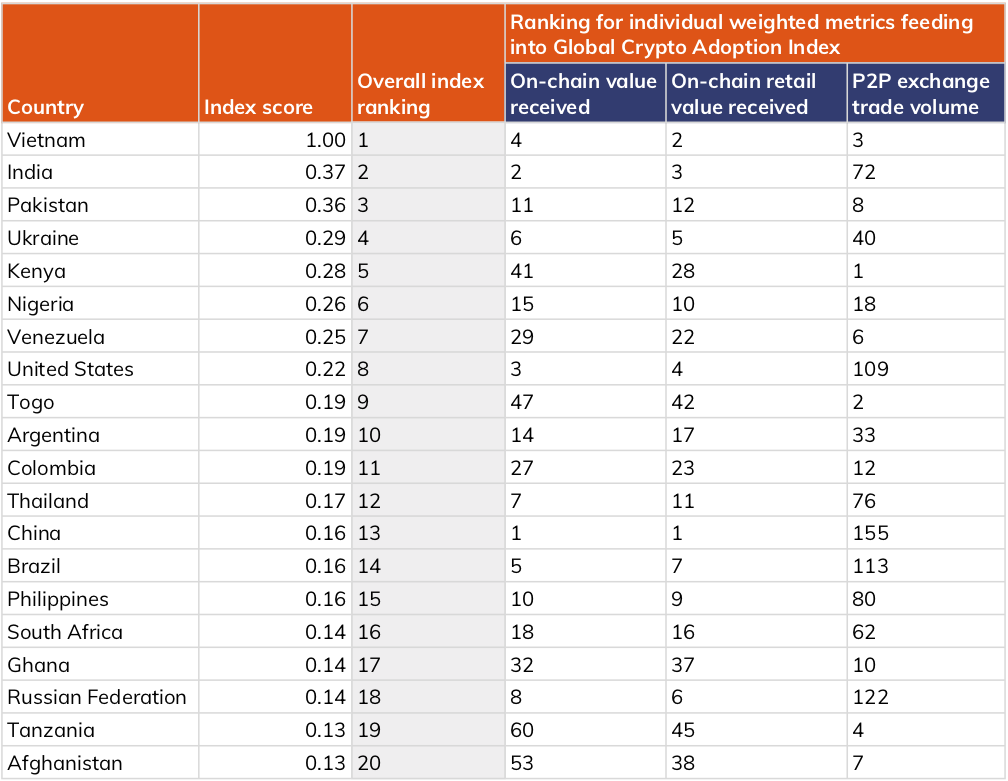

The table below shows the top 20 countries in our 2021 Global Crypto Adoption Index, as well as their rankings in the three component metrics that make up the overall rankings.

Three key trends stood out to us as significant.

The global adoption of cryptocurrencies is skyrocketing

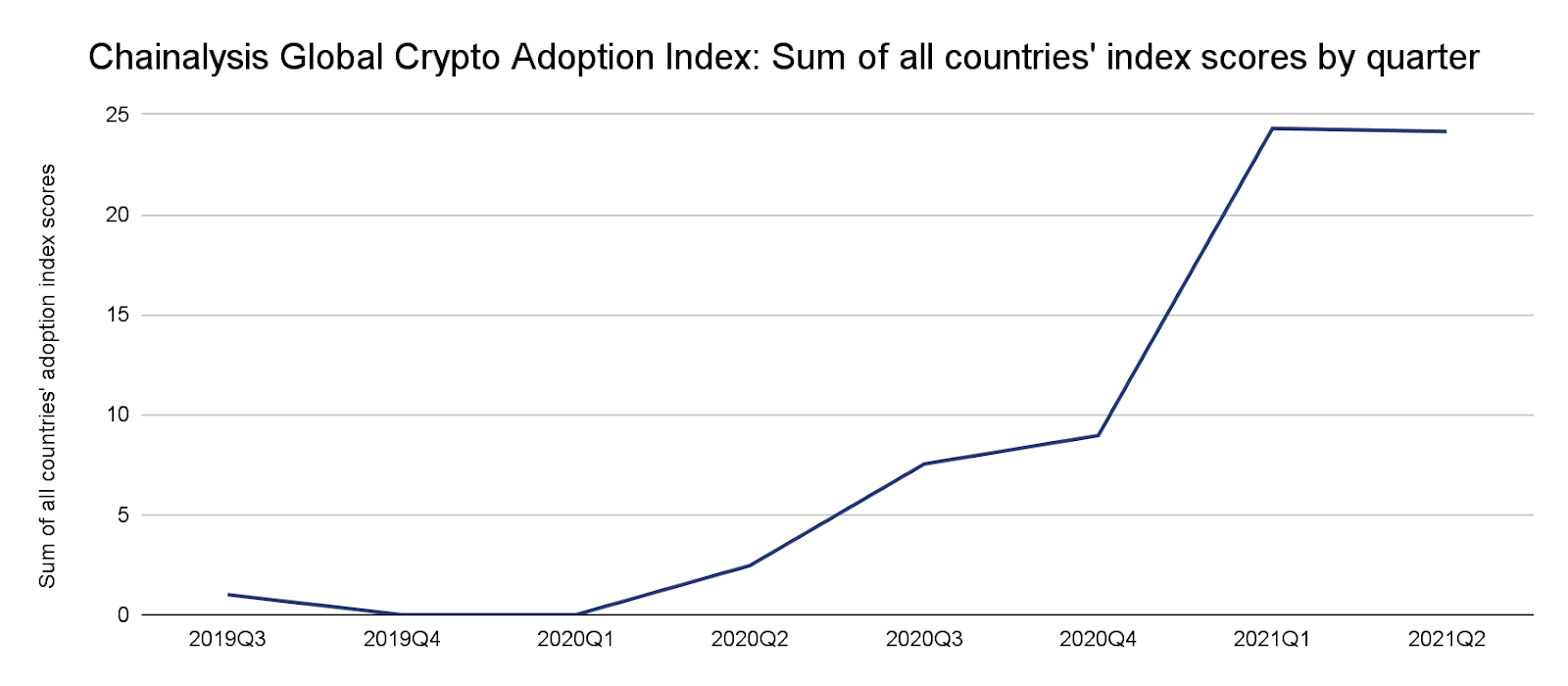

Our data shows that residents of more and more countries around the world are taking the plunge into cryptocurrency or seeing existing adoption increase. In the chart below, we have applied our index methodology globally by adding all 154 countries’ index scores – composed of the three components we describe above – for each quarter from Q2 2019 to date.

At the end of Q2 2020, after a period of little growth, total global adoption stood at 2.5, based on our summarized country index scores. At the end of Q2 2021, that total stands at 24, indicating that global adoption has grown more than 2300% since Q3 2019 and more than 881% in the past year. Our research suggests that reasons for this increased adoption vary around the world – in emerging markets, many are turning to cryptocurrency to preserve their savings in the face of currency devaluation, send and receive remittances, and conduct business transactions, while in North America is being adopted, Western Europe and East Asia have been largely driven by institutional investment in recent years. In a year where cryptocurrency prices have risen dramatically, each region’s respective reasons for embracing the asset class seem to have proven compelling.

Adoption in emerging markets is growing, driven by P2P platforms

Several countries in emerging markets, including Kenya, Nigeria, Vietnam and Venezuela, rank high on our crypto index largely because they have large transaction volumes on peer-to-peer (P2P) platforms when adjusted for PPP per capita and internet usage population. Our interviews with experts in these countries revealed that many residents use P2P cryptocurrency exchanges as their primary ramp to cryptocurrency, often because they do not have access to centralized exchanges.

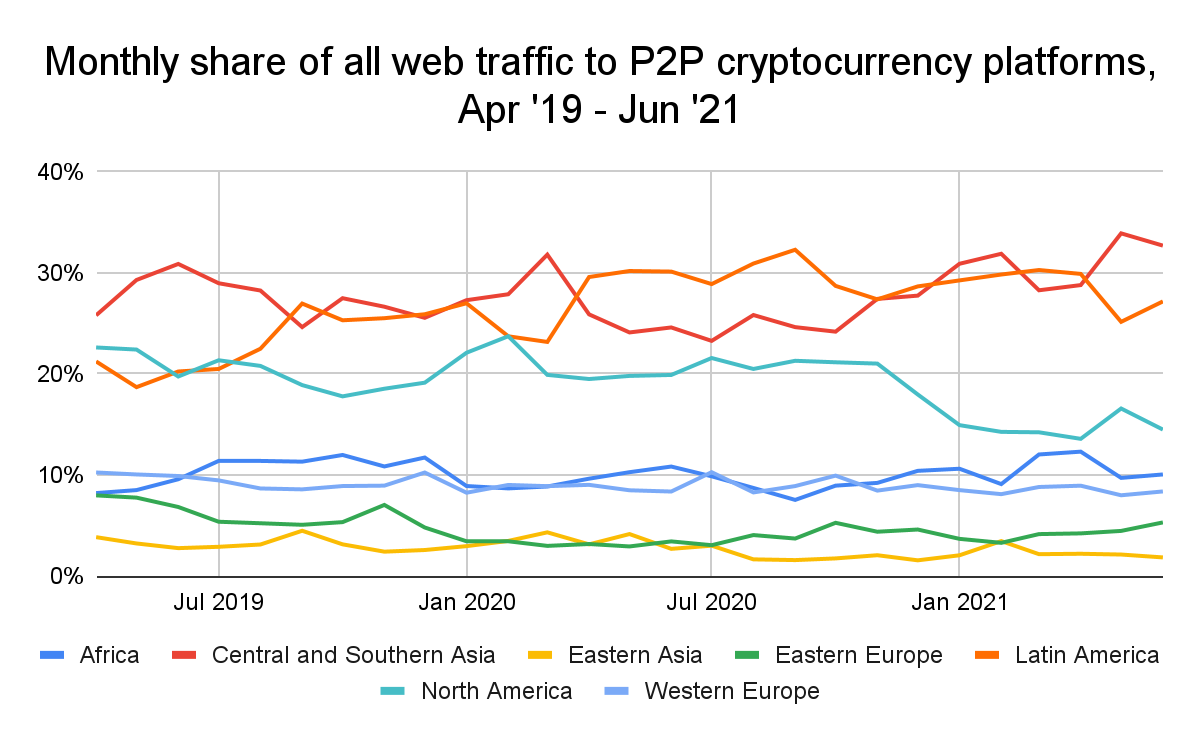

Knowing this, it is no surprise that regions with many emerging markets account for a large proportion of web traffic to P2P services’ websites.

Central and South Asia, Latin America and Africa send more web traffic to P2P platforms than regions whose countries tend to have larger economies, such as Western Europe and East Asia.

Many emerging markets are facing significant currency devaluation, driving residents to buy cryptocurrencies on P2P platforms to preserve their savings. Others in these areas use cryptocurrency to carry out international transactions, either for individual remittances or for commercial use cases, such as the purchase of goods to import and sell. Many emerging markets represented here limit the amount of national currency residents can withdraw from the country. Cryptocurrencies like Bitcoin (BTC), Ethereum (ETH) and stablecoins give those residents a way to bypass those limits to meet their financial needs.

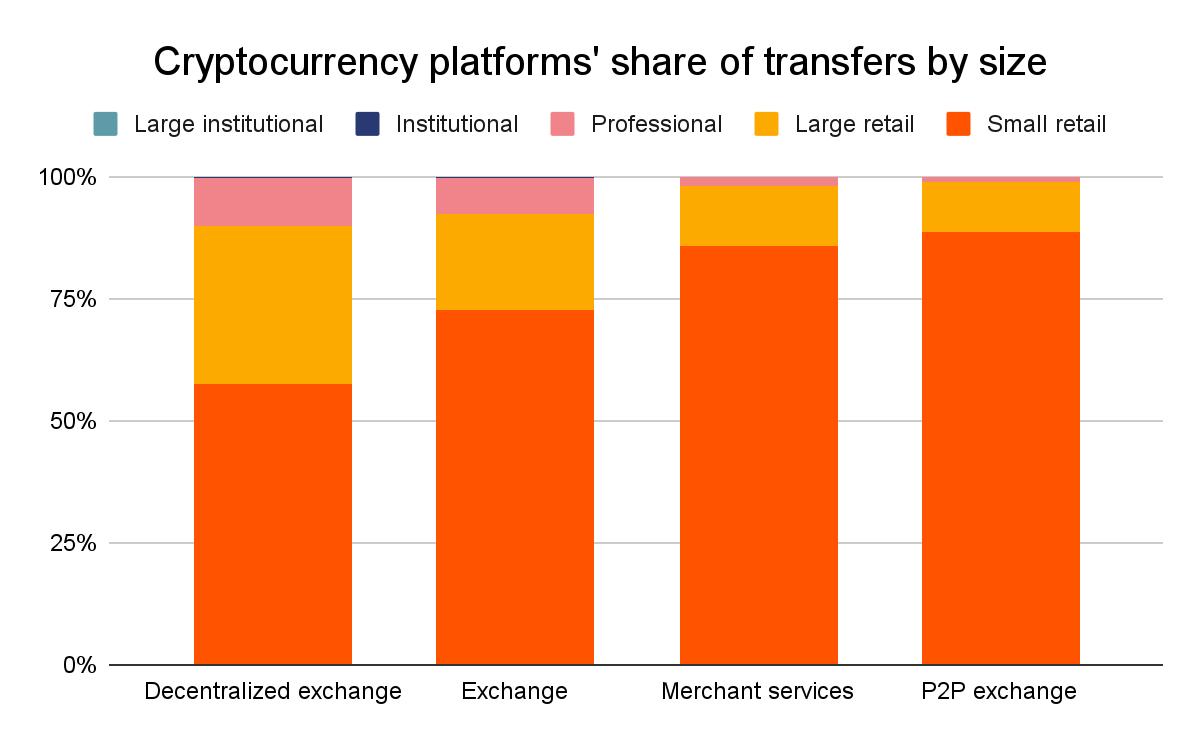

This adds to an interesting dynamic whereby P2P platforms have a larger share of total transaction volume consisting of smaller, retail-sized payments under $10,000 worth of cryptocurrency.

This makes sense given the use cases we have described, as payment payments and personal and commercial transactions executed by traders in emerging markets are likely to be smaller than transactions executed by professional traders or institutional investors.

China and the US dip into our rankings

Last year, China ranked fourth on our global adoption index while the US ranked sixth. This year, the US ranks eighth while China ranks 13th. The biggest reason both countries have fallen is that their rankings in P2P trade volume weighted by internet-using population have fallen dramatically – China has fallen from 53rd in this component to 155th, while the US has fallen from 16th to 109th.

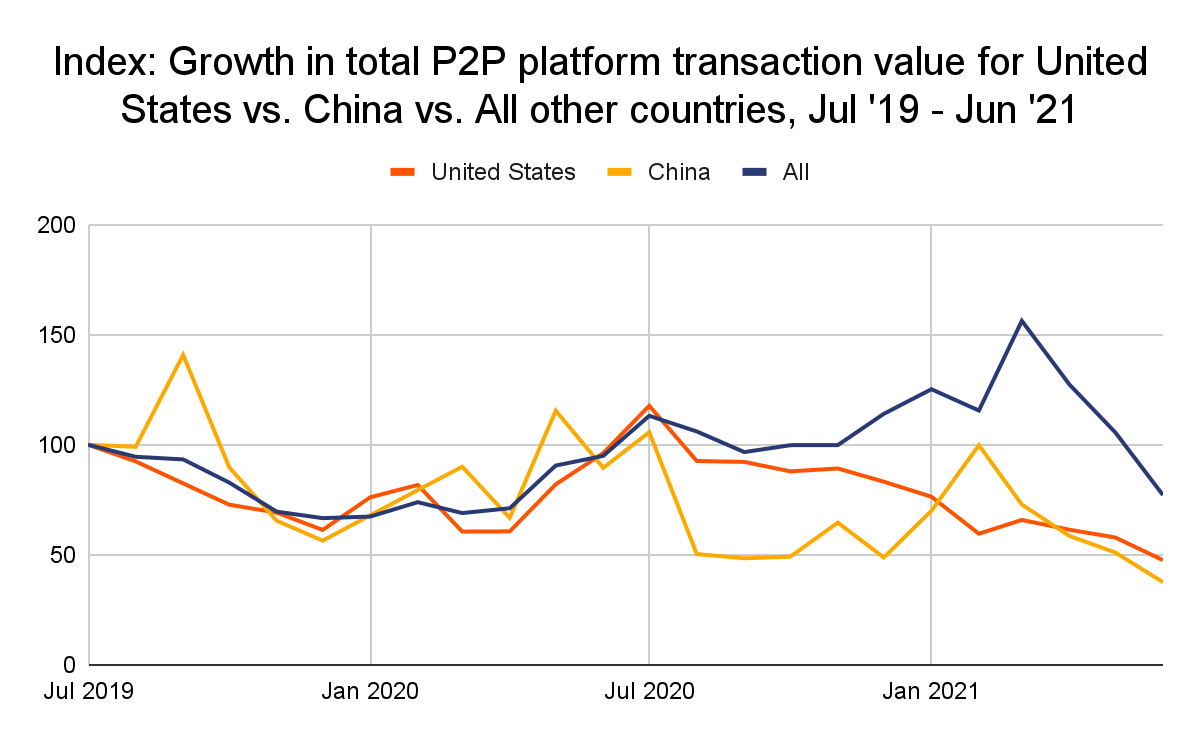

Further analysis shows how far P2P volumes have fallen in the two countries compared to global volumes. We show this in the index chart below, which shows relative change in P2P volumes for the US and China compared to global totals.

P2P transaction volume for the US and China moved roughly in line with the global total until they began to diverge around June 2020. At that point, the US and China are seeing their P2P transaction volume shrink as the rest of the world grows. While all three decline dramatically starting in March 2021, the US and China decline more and remain lower than global totals. This activity may reflect increasing professionalization and institutionalization of cryptocurrency trading in the United States, and in China’s case, may be related to ongoing government crackdowns on cryptocurrency trading.

What will drive the next wave of adoption?

Our data shows that growing transaction volume for centralized services and the explosive growth of DeFi are driving the use of cryptocurrencies in the developed world and in countries that already had significant adoption, while P2P platforms are driving new adoption in emerging markets. Our biggest question for the next twelve months is how much adoption will continue on those platform categories compared to new and upcoming models we haven’t seen yet. However, the clear takeaway is this: Cryptocurrency adoption has skyrocketed over the past twelve months, and the variation in the countries contributing to it shows that cryptocurrency is a truly global phenomenon.

This blog is a preview of our 2021 Geography of Cryptocurrency report. Join here to download the whole thing!

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news